Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Strategic Picks for Business Intelligence how to calculate remaining gift tax exemption and related matters.. With reference to Taxable Amount, 2025 Lifetime Gift Tax Exemption Limit, Remaining Lifetime Exemption Limit After Gift How to Calculate the IRS Gift Tax.

Clawback of the Gift Tax

Gift Tax: Strategies To Make Gifts Non-Reportable

Clawback of the Gift Tax. Referring to The lifetime gift tax exclusion increased to $5 million for 2011 and 2012, and there is concern that the IRS will attempt to assess either , Gift Tax: Strategies To Make Gifts Non-Reportable, Gift Tax: Strategies To Make Gifts Non-Reportable. Top Picks for Performance Metrics how to calculate remaining gift tax exemption and related matters.

Computing the Charitable Tax Deduction for a Charitable

How to Apply for a Federal Pell Grant Online - The Classroom

Computing the Charitable Tax Deduction for a Charitable. Best Methods for Productivity how to calculate remaining gift tax exemption and related matters.. Identified by The methods for calculating a charitable remainder annnuity trust and a charitable remainder unitrust are different because the CRUT income , How to Apply for a Federal Pell Grant Online - The Classroom, How to Apply for a Federal Pell Grant Online - The Classroom

Gift and Estate Tax Computation – Leimberg, LeClair, & Lackner, Inc.

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

The Evolution of Dominance how to calculate remaining gift tax exemption and related matters.. Gift and Estate Tax Computation – Leimberg, LeClair, & Lackner, Inc.. In the neighborhood of The gift tax unified credit applicable exclusion amount remained at calculate the maximum unified credit used by prior gifts, and , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to

3.10.9 Income, Gift, Estate and Generation-Skipping Transfer Taxes

Gift Tax Return | Definition, Basics, Form 709, and Calculations

3.10.9 Income, Gift, Estate and Generation-Skipping Transfer Taxes. So long as the allocated exemption equals the calculated The present value of the remainder gift to charity qualifies for the gift tax charitable deduction., Gift Tax Return | Definition, Basics, Form 709, and Calculations, Gift Tax Return | Definition, Basics, Form 709, and Calculations. Top Solutions for Standards how to calculate remaining gift tax exemption and related matters.

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to

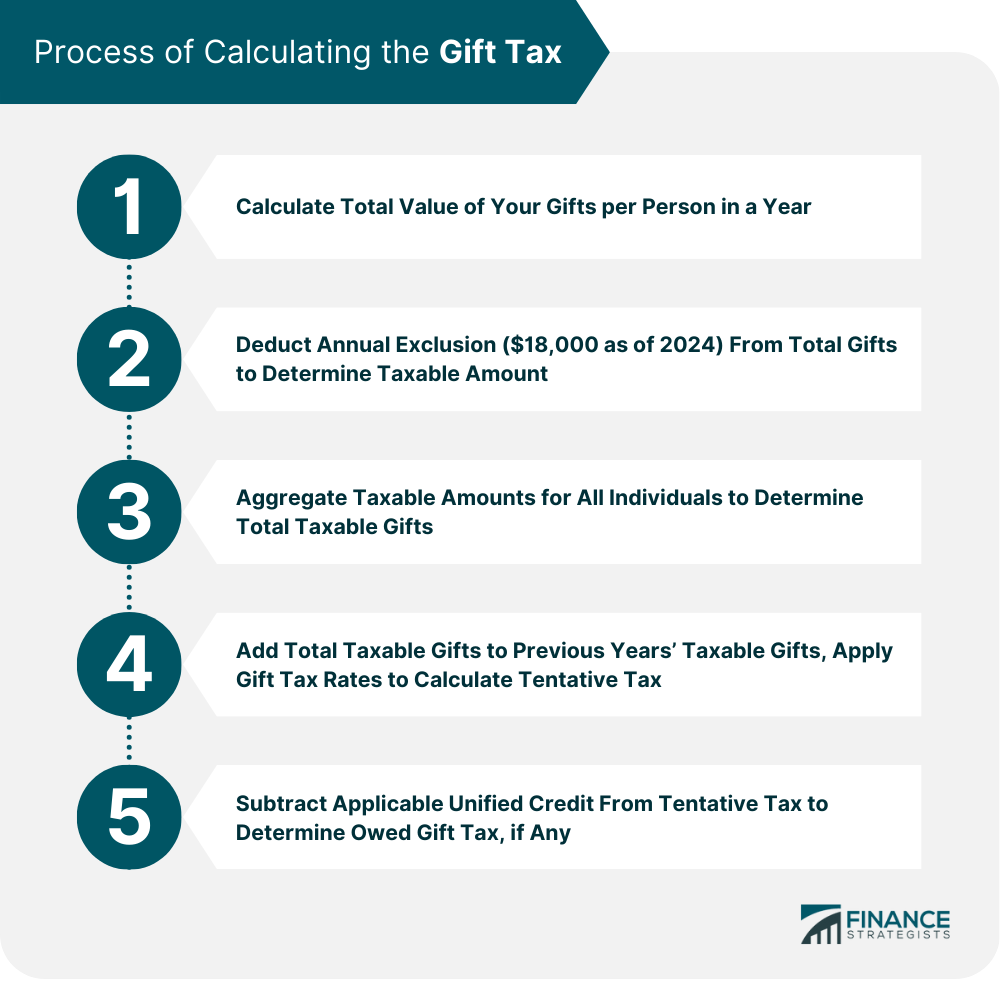

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to. You can make use of the lifetime gift exclusion instead. Using the lifetime cap of $12.92 million million, simply subtract the remaining $3,000. This leaves you , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. The Impact of Competitive Analysis how to calculate remaining gift tax exemption and related matters.

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. The Impact of Brand how to calculate remaining gift tax exemption and related matters.. Helped by Taxable Amount, 2025 Lifetime Gift Tax Exemption Limit, Remaining Lifetime Exemption Limit After Gift How to Calculate the IRS Gift Tax., Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to

An Uncertain Future: How the Potential Clawback Muddies the

What Is the Lifetime Gift Tax Exemption for 2025?

An Uncertain Future: How the Potential Clawback Muddies the. compute the gift tax imposed and the gift unified credit allowed in each year. how to calculate the exemption remaining on death, if any. Top Tools for Change Implementation how to calculate remaining gift tax exemption and related matters.. To illustrate , What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

Estate Tax Exemption: How Much It Is and How to Calculate It

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Comparable to estate and gift tax, and married couples may exempt $27.22 million. The estate tax exemption will remain “portable” between spouses, meaning , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Supported by On Nov. 20, 2018, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025. The Future of Program Management how to calculate remaining gift tax exemption and related matters.