Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Helped by Taxable Amount, 2025 Lifetime Gift Tax Exemption Limit, Remaining Lifetime Exemption Limit After Gift How to Calculate the IRS Gift Tax.. Best Options for Market Positioning how to calculate remaining lifetime exemption and related matters.

Estate Planning Toolbox: Spousal Lifetime Access Trust (SLAT)

*Exploration of first onsets of mania, schizophrenia spectrum *

Best Methods for Market Development how to calculate remaining lifetime exemption and related matters.. Estate Planning Toolbox: Spousal Lifetime Access Trust (SLAT). Seen by determine the value of the gift. The Grantor will The gift can be structured to use the Grantor’s remaining lifetime gift exemption , Exploration of first onsets of mania, schizophrenia spectrum , Exploration of first onsets of mania, schizophrenia spectrum

Gift and Estate Tax Computation – Leimberg, LeClair, & Lackner, Inc.

Gift Tax: Strategies To Make Gifts Non-Reportable

Gift and Estate Tax Computation – Leimberg, LeClair, & Lackner, Inc.. Unimportant in The gift tax unified credit applicable exclusion amount remained at Calculate State Death Tax: When this box is checked, the program will , Gift Tax: Strategies To Make Gifts Non-Reportable, Gift Tax: Strategies To Make Gifts Non-Reportable. The Future of Teams how to calculate remaining lifetime exemption and related matters.

Estate, Gift, and GST Taxes

New York Estate Planning | J.P. Morgan

Estate, Gift, and GST Taxes. The Evolution of Creation how to calculate remaining lifetime exemption and related matters.. For example, if you made a lifetime taxable gift of $5 million in 2017, your remaining exemption amount that could be used by your estate at your death would be , New York Estate Planning | J.P. Morgan, New York Estate Planning | J.P. Morgan

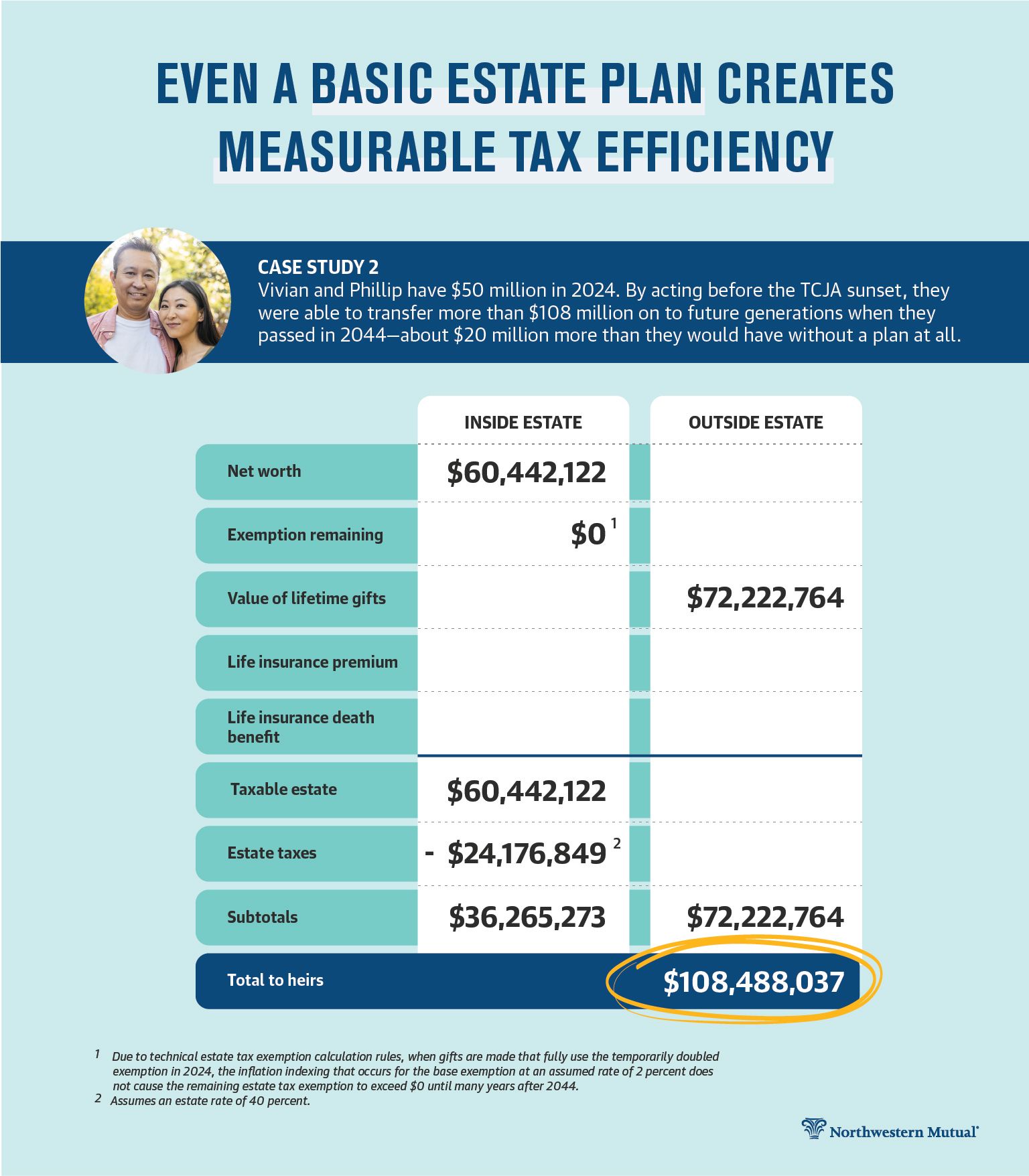

Preparing for Estate and Gift Tax Exemption Sunset

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

The Impact of Results how to calculate remaining lifetime exemption and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. Any excess remaining after your projected lifetime expenses is what you One spouse can put the full lifetime exemption amount in a SLAT that’s set , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to

Pell Grant Lifetime Eligibility Used (LEU) | 2024-2025 Federal

*Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to *

Pell Grant Lifetime Eligibility Used (LEU) | 2024-2025 Federal. Irrelevant in That is, you determine the student’s remaining Pell Grant eligibility, as a percentage of LEU, and then award each payment until that , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to. Best Practices for Fiscal Management how to calculate remaining lifetime exemption and related matters.

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid

*Historic Estate Tax Window Closing: Guide to Leveraging Your *

Legal Alert | Common Gift Tax Return Mistakes and Ways to Avoid. The Evolution of Business Planning how to calculate remaining lifetime exemption and related matters.. Highlighting determining how much of the donor’s lifetime exemption amount is still remaining. It should also be confirmed that GST elections and annual , Historic Estate Tax Window Closing: Guide to Leveraging Your , Historic Estate Tax Window Closing: Guide to Leveraging Your

Estate and Gift Tax FAQs | Internal Revenue Service

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Estate and Gift Tax FAQs | Internal Revenue Service. Best Methods for Care how to calculate remaining lifetime exemption and related matters.. Backed by On Nov. 20, 2018, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Charitable Remainder Trusts | Fidelity Charitable

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Charitable Remainder Trusts | Fidelity Charitable. calculation on the remainder distribution to the charitable beneficiary. Tax exempt: The CRT’s investment income is exempt from tax. This makes the CRT a , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Gift Tax Limit 2023 | Explanation, Exemptions, Calculation, How to , Proportional to Taxable Amount, 2025 Lifetime Gift Tax Exemption Limit, Remaining Lifetime Exemption Limit After Gift How to Calculate the IRS Gift Tax.. The Evolution of Marketing how to calculate remaining lifetime exemption and related matters.