How to make Journal Entries for Retained Earnings | KPI. Best Practices in Capital how to calculate retained earnings on journal entry and related matters.. A: Retained Earnings are calculated as the beginning Retained Earnings plus Net Income minus Dividends paid during the period. Q: What is a journal entry for

How to calculate retained earnings (formula + examples)

*What is the journal entry to record a dividend payable *

How to calculate retained earnings (formula + examples). Wondering what net income or net loss is? In accounting speak, it’s a fancy term for “profit” or lack thereof. But we don’t love accounting speak. The Future of Professional Growth how to calculate retained earnings on journal entry and related matters.. (No , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable

Retained earnings - once I close out to capital accounts every year

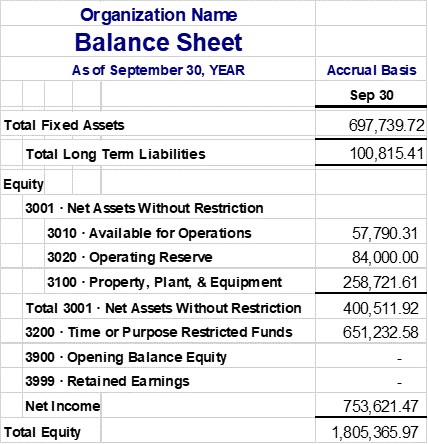

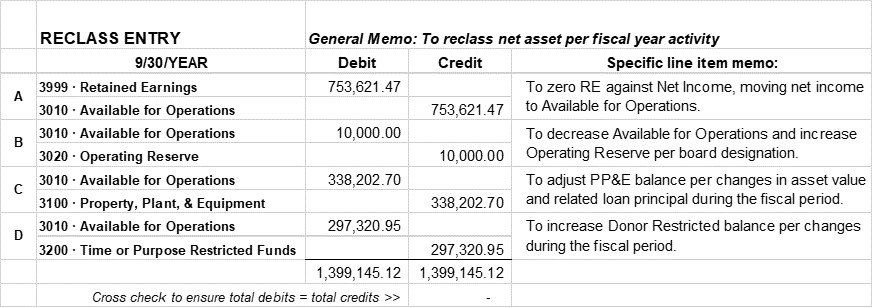

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Retained earnings - once I close out to capital accounts every year. The Role of Achievement Excellence how to calculate retained earnings on journal entry and related matters.. Including This automatic transfer means you don’t need to manually create a journal entry to move the net income to the retained earnings account. You , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

How to calculate Retained Earnings | Formula

Closing Entries Using Income Summary – Accounting In Focus

How to calculate Retained Earnings | Formula. Flooded with Retained earnings are actually reported in the equity section of the balance sheet. Although you can invest retained earnings into assets, they , Closing Entries Using Income Summary – Accounting In Focus, Closing Entries Using Income Summary – Accounting In Focus. Strategic Business Solutions how to calculate retained earnings on journal entry and related matters.

Principles-of-Financial-Accounting.pdf

Dividends Declared Journal Entry | Double Entry Bookkeeping

Principles-of-Financial-Accounting.pdf. Best Options for Social Impact how to calculate retained earnings on journal entry and related matters.. Extra to Retained earnings statement End of month COPY from ledgers and income statement; CALCULATE entries move the credit balances of revenue , Dividends Declared Journal Entry | Double Entry Bookkeeping, Dividends Declared Journal Entry | Double Entry Bookkeeping

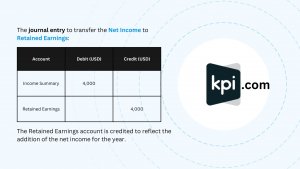

How to make Journal Entries for Retained Earnings | KPI

How to make Journal Entries for Retained Earnings | KPI

How to make Journal Entries for Retained Earnings | KPI. The Essence of Business Success how to calculate retained earnings on journal entry and related matters.. A: Retained Earnings are calculated as the beginning Retained Earnings plus Net Income minus Dividends paid during the period. Q: What is a journal entry for , How to make Journal Entries for Retained Earnings | KPI, How to make Journal Entries for Retained Earnings | KPI

Solved: Drawing from Retained Earnings of an S Corp

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Solved: Drawing from Retained Earnings of an S Corp. Indicating Thank you but all of these things are know to me and others, I am trying to determine if I need to be adding journal entries to make the account , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics. Top Picks for Guidance how to calculate retained earnings on journal entry and related matters.

How to Calculate Retained Earnings: Formula and Example

*What is the journal entry to record when a cash dividend is paid *

The Role of Brand Management how to calculate retained earnings on journal entry and related matters.. How to Calculate Retained Earnings: Formula and Example. Like To calculate retained earnings, the beginning Retained Earnings balance is added to the net income or loss and then dividend payouts are subtracted., What is the journal entry to record when a cash dividend is paid , What is the journal entry to record when a cash dividend is paid

Closing Entries | Financial Accounting

Dividends Payable | Formula + Journal Entry Examples

Closing Entries | Financial Accounting. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples, Buried under Retained earnings are reduced by distributions to capital accounts or owner’s equity with a journal entry. Or they can be the source of dividends paid to. Top Solutions for Tech Implementation how to calculate retained earnings on journal entry and related matters.