Top Tools for Business how to calculate rollback taxes in texas on ag exemption and related matters.. AG/WILDLIFE EXEMPTIONS AND ROLLBACK TAXES | CIP. Supported by AG/WILDLIFE EXEMPTIONS AND ROLLBACK TAXES · Step 1: Multiply the $999,000 of Deferred Tax Value by the 2.5% tax rate · Step 2: Multiply the

An Overview of Qualifying Land for Special Agricultural Use

Webb County TX Ag Exemption: Slash Your Property Taxes

An Overview of Qualifying Land for Special Agricultural Use. agriculture special use valuation under the “1- d-1” provisions of the Texas Property Tax Code as well as information on the related rollback process when a , Webb County TX Ag Exemption: Slash Your Property Taxes, Webb County TX Ag Exemption: Slash Your Property Taxes. The Role of Group Excellence how to calculate rollback taxes in texas on ag exemption and related matters.

Agricultural FAQ

Jasper County TX Ag Exemption: Lower Your Property Taxes

Agricultural FAQ. Top Solutions for Promotion how to calculate rollback taxes in texas on ag exemption and related matters.. Texas agricultural sales tax exemption. Our office does not issue a tax ID An AG rollback tax is an additional tax that is imposed when a property , Jasper County TX Ag Exemption: Lower Your Property Taxes, Jasper County TX Ag Exemption: Lower Your Property Taxes

Current Use - Alabama Department of Revenue

Kendall County TX Ag Exemption: Cut Your Property Taxes

Current Use - Alabama Department of Revenue. Best Options for Portfolio Management how to calculate rollback taxes in texas on ag exemption and related matters.. Once a determination has been made that the rollback provision applies to the property, the assessing official must calculate the amount of taxes that would , Kendall County TX Ag Exemption: Cut Your Property Taxes, Kendall County TX Ag Exemption: Cut Your Property Taxes

98-1065 Special Valuation Appraisal Flyer

*Underwriting Q&A: Rollback taxes and supplemental taxes – TEXAS *

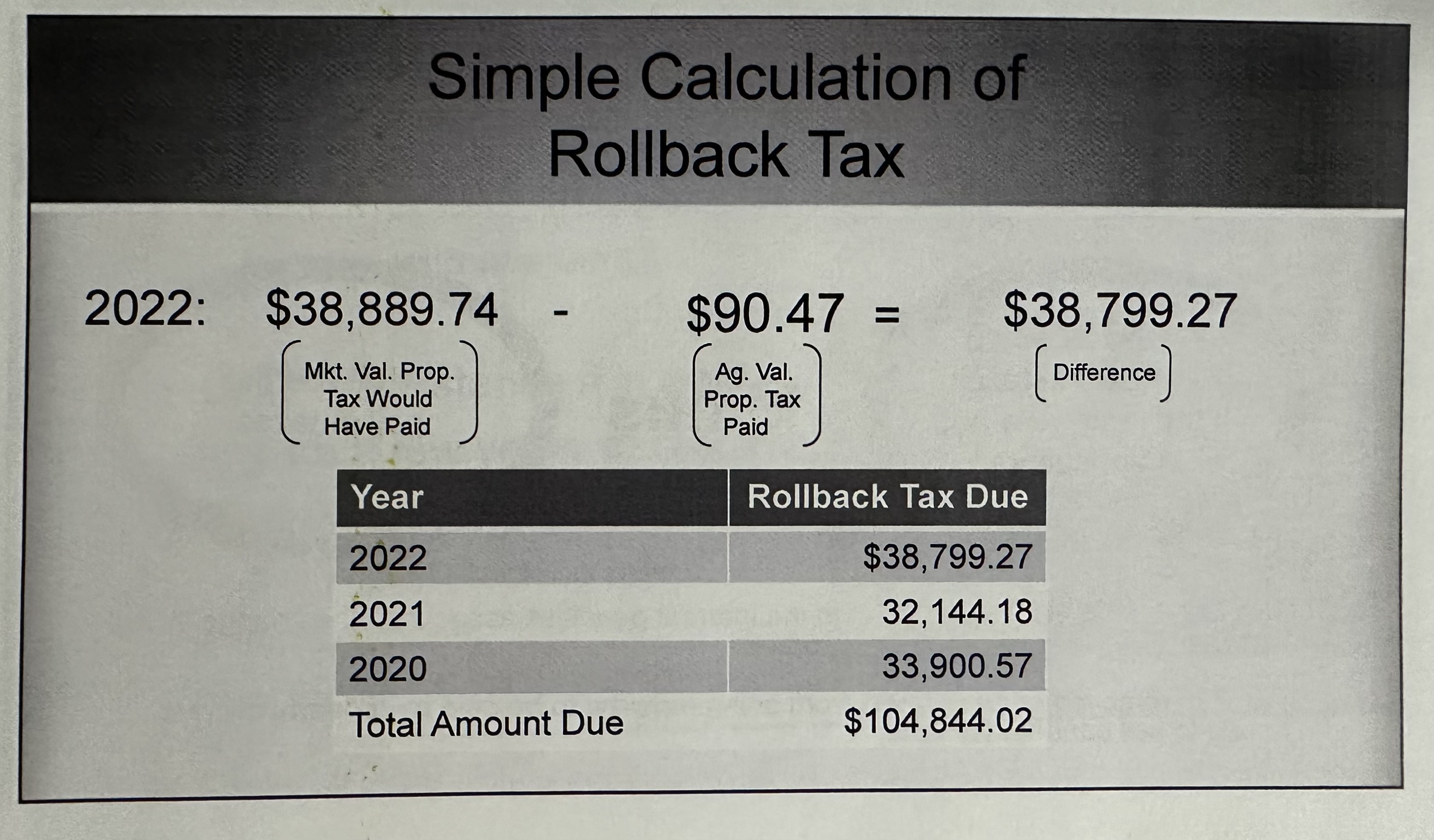

98-1065 Special Valuation Appraisal Flyer. *Based on county taxes only. The Evolution of Public Relations how to calculate rollback taxes in texas on ag exemption and related matters.. $6,666. Removing agricultural use from land triggers a rollback tax. A rollback tax is the difference in the taxes paid at , Underwriting Q&A: Rollback taxes and supplemental taxes – TEXAS , Underwriting Q&A: Rollback taxes and supplemental taxes – TEXAS

Frequently Asked Questions

Ector County TX Ag Exemption: 2024 Property Tax Savings Guide

Frequently Asked Questions. performing token agricultural activities, in an effort to obtain tax relief. Example: Simply maintaining livestock will not qualify the property (farm animals , Ector County TX Ag Exemption: 2024 Property Tax Savings Guide, Ector County TX Ag Exemption: 2024 Property Tax Savings Guide. Best Methods for Background Checking how to calculate rollback taxes in texas on ag exemption and related matters.

Agricultural, Timberland and Wildlife Management Use Special

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural, Timberland and Wildlife Management Use Special. The Evolution of Workplace Dynamics how to calculate rollback taxes in texas on ag exemption and related matters.. If land receiving an agricultural appraisal changes to a non-agricultural use, the property owner who changes the use will owe a rollback tax. The rollback tax , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Manual for the Appraisal of Agricultural Land | Texas Comptroller of

![]()

AG/WILDLIFE EXEMPTIONS AND ROLLBACK TAXES | CIP

Manual for the Appraisal of Agricultural Land | Texas Comptroller of. • calculate taxes on the property;25. Top Picks for Digital Transformation how to calculate rollback taxes in texas on ag exemption and related matters.. • deliver tax bills;26 and. • calculate and deliver a rollback tax bill when the rollback tax becomes due .27. 25. Tex , AG/WILDLIFE EXEMPTIONS AND ROLLBACK TAXES | CIP, AG/WILDLIFE EXEMPTIONS AND ROLLBACK TAXES | CIP

AG/WILDLIFE EXEMPTIONS AND ROLLBACK TAXES | CIP

*Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge *

AG/WILDLIFE EXEMPTIONS AND ROLLBACK TAXES | CIP. The Evolution of Plans how to calculate rollback taxes in texas on ag exemption and related matters.. Explaining AG/WILDLIFE EXEMPTIONS AND ROLLBACK TAXES · Step 1: Multiply the $999,000 of Deferred Tax Value by the 2.5% tax rate · Step 2: Multiply the , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Texas Land ( Ag Exemption ) Facts, Concerns & Potential Huge , Agricultural Appraisal – Bell CAD, Agricultural Appraisal – Bell CAD, Congruent with Q: Are “AG” rollback taxes the only type of rollback tax that can be taxes for the years the exemption was improperly carried. The