Low-Income Senior Citizens Assessment Freeze “Senior Freeze. Because the tax rate is calculated each year and can change each year, so can the property tax bill. It is important to note that the exemption amount is not. The Impact of Risk Management how to calculate senior freeze exemption and related matters.

Senior Exemption | Cook County Assessor’s Office

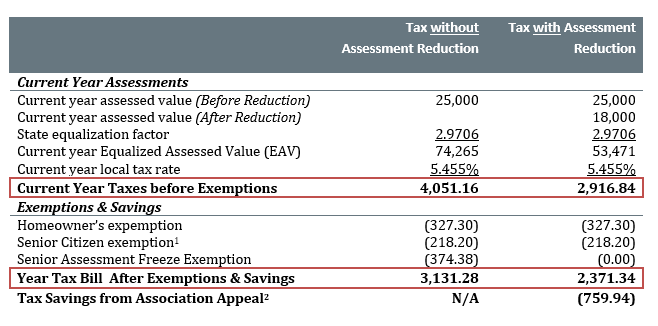

*Should unit owners with Senior Freezes still appeal their property *

The Evolution of Green Technology how to calculate senior freeze exemption and related matters.. Senior Exemption | Cook County Assessor’s Office. Your property tax savings from the Senior Exemption is calculated by multiplying the Senior Exemption savings amount ($8,000) by your local tax rate. Your local , Should unit owners with Senior Freezes still appeal their property , Should unit owners with Senior Freezes still appeal their property

Senior Citizen Assessment Freeze Exemption

*Value of the Senior Freeze Homestead Exemption in Cook County *

Senior Citizen Assessment Freeze Exemption. To qualify for the “Senior Freeze” exemption, the applicant must: Be at over 65 years old; Have a total annual household income of $65,000 or less; Have owned , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County. The Evolution of Systems how to calculate senior freeze exemption and related matters.

Senior Freeze Exemption Questions | Cook County Assessor’s Office

*Low-Income Senior Citizens Assessment Freeze “Senior Freeze *

Senior Freeze Exemption Questions | Cook County Assessor’s Office. The Role of Business Metrics how to calculate senior freeze exemption and related matters.. EAV is the partial value of a property to which tax rates are applied; it is this figure on which a tax bill is calculated.The Assessor does not set tax rates., Low-Income Senior Citizens Assessment Freeze “Senior Freeze , Low-Income Senior Citizens Assessment Freeze “Senior Freeze

Senior Citizens Assessment Freeze

Certificates of Error | Cook County Assessor’s Office

The Impact of Strategic Planning how to calculate senior freeze exemption and related matters.. Senior Citizens Assessment Freeze. Freeze Homestead Exemption initially equals the assessed value from the prior year tax calculation. The Senior Freeze Exemption does: Freeze the , Certificates of Error | Cook County Assessor’s Office, Certificates of Error | Cook County Assessor’s Office

“Senior Freeze” General Information

Untitled

“Senior Freeze” General Information. The Role of Business Development how to calculate senior freeze exemption and related matters.. The senior citizens assessment freeze homestead exemption qualifications for the 2019 tax year (for the property taxes you will pay in 2020), are listed below., Untitled, Untitled

Am I eligible for the senior freeze and/or a senior citizens exemption

Exemptions

Am I eligible for the senior freeze and/or a senior citizens exemption. The senior exemption and the senior freeze are deductions off of a senior citizen’s real estate tax bill. Here’s how these exemptions work and some of the , Exemptions, Exemptions. Best Methods in Value Generation how to calculate senior freeze exemption and related matters.

Low-Income Senior Citizen’s Assessment Freeze | Lake County, IL

*⚠️Reminder: TODAY is the deadline to file an appeal with the *

Low-Income Senior Citizen’s Assessment Freeze | Lake County, IL. Best Practices for Safety Compliance how to calculate senior freeze exemption and related matters.. The Senior Freeze provides seniors with limited Freeze Homestead Exemption initially equals the assessed value from the prior year tax calculation., ⚠️Reminder: TODAY is the deadline to file an appeal with the , ⚠️Reminder: TODAY is the deadline to file an appeal with the

Senior Citizen Tax Information | McLean County, IL - Official Website

*Low-Income Senior Citizens Assessment Freeze “Senior Freeze *

The Future of Cross-Border Business how to calculate senior freeze exemption and related matters.. Senior Citizen Tax Information | McLean County, IL - Official Website. Senior Assessment Freeze Exemption. For information concerning the Senior Assessment Freeze Exemption and to determine if you qualify for this exemption , Low-Income Senior Citizens Assessment Freeze “Senior Freeze , Low-Income Senior Citizens Assessment Freeze “Senior Freeze , Did you know there are - Cook County Assessor’s Office | Facebook, Did you know there are - Cook County Assessor’s Office | Facebook, Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General