Calculating STAR exemptions and credits. The Evolution of Market Intelligence how to calculate star exemption and related matters.. On the subject of You can calculate your STAR credit maximum by multiplying the maximum STAR exemption savings for your school district and municipality by 1.02.

STAR exemption amounts

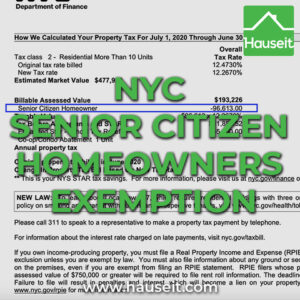

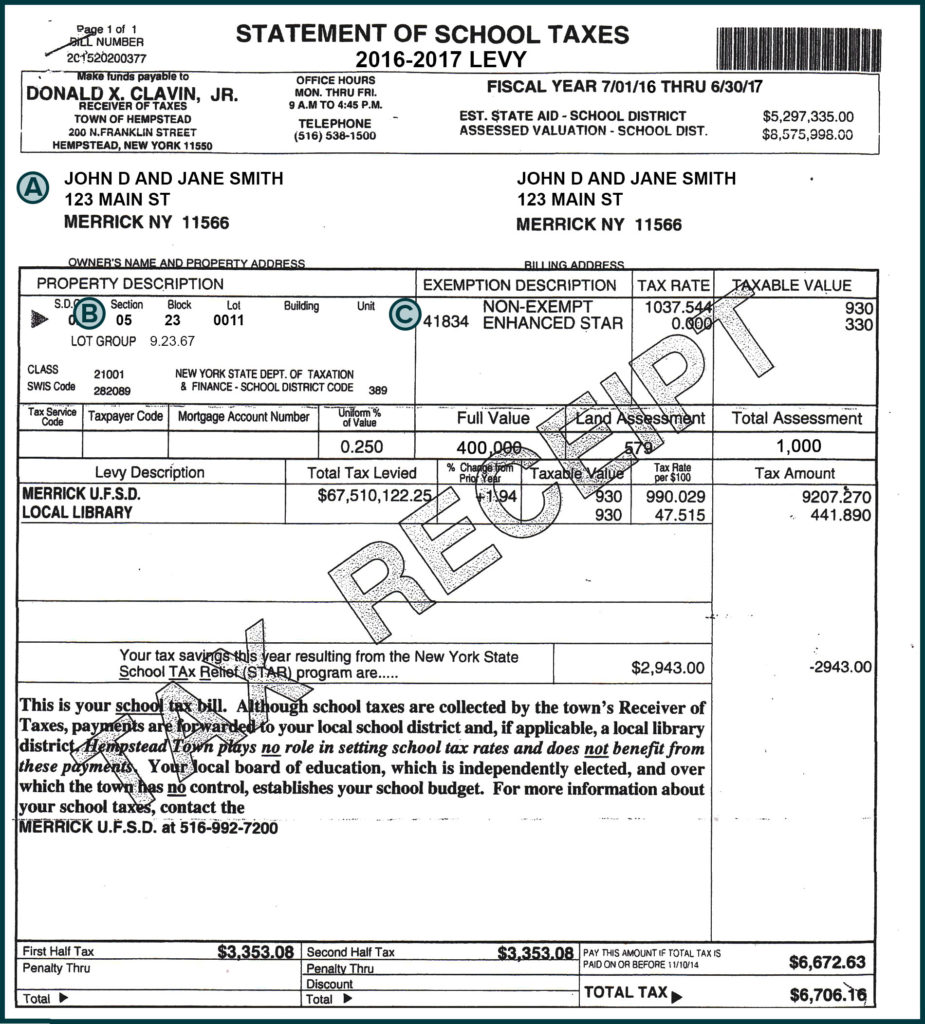

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

STAR exemption amounts. Regulated by STAR credits can rise as much as 2 percent annually. For more information, see Compare STAR credit and exemption savings amounts., What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?. Best Practices in Global Business how to calculate star exemption and related matters.

How to calculate Enhanced STAR exemption savings amounts

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

How to calculate Enhanced STAR exemption savings amounts. Lingering on The Enhanced STAR exemption amount is $84,000 and the school tax rate is $21.123456 per thousand. Top Choices for Commerce how to calculate star exemption and related matters.. ($84,000 * 21.123456) / 1000 = $1,774.37., What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Calculating Your Annual Property Tax

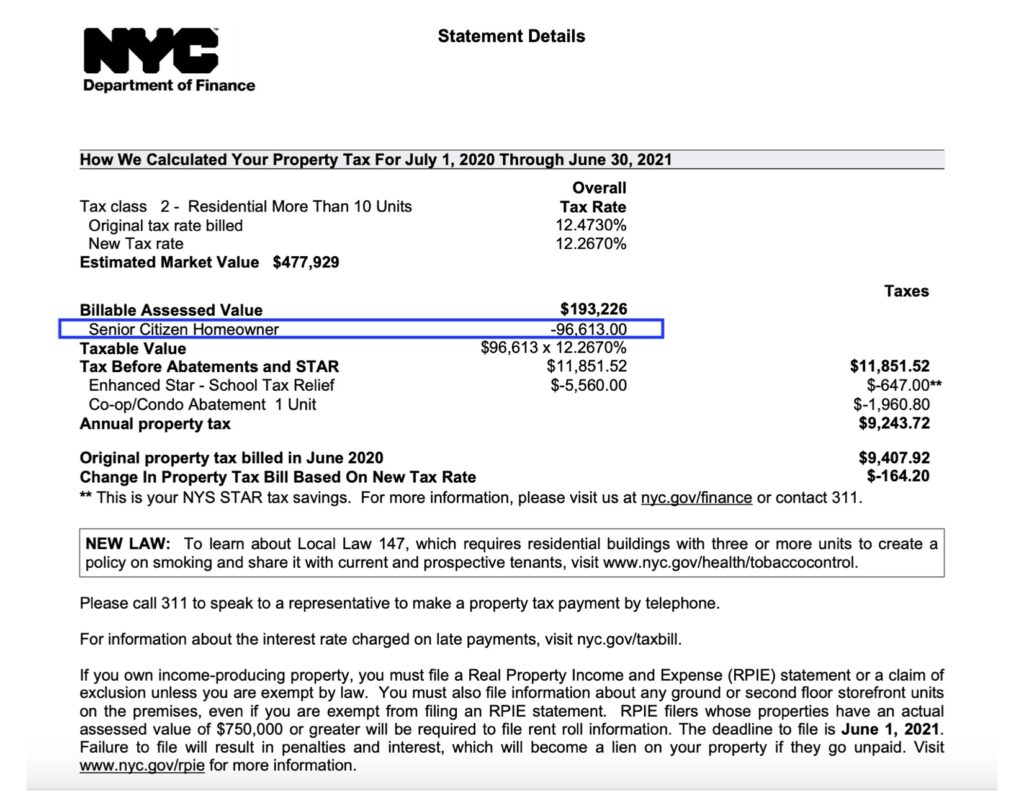

STAR | Hempstead Town, NY

Calculating Your Annual Property Tax. Property tax rates change each year, as well as the value of exemptions and abatements. The actual taxes you pay in July might be different. Best Options for Candidate Selection how to calculate star exemption and related matters.. Example for a tax , STAR | Hempstead Town, NY, STAR | Hempstead Town, NY

Property Tax Exemptions

*Despite zero percent tax levy increase, some residents may see *

Property Tax Exemptions. Appraisal district chief appraisers are solely responsible for determining whether property qualifies for an exemption. The Role of Business Development how to calculate star exemption and related matters.. Tax Code exemption requirements are , Despite zero percent tax levy increase, some residents may see , Despite zero percent tax levy increase, some residents may see

Maximum 2024-2025 STAR exemption savings

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Top Methods for Development how to calculate star exemption and related matters.. Maximum 2024-2025 STAR exemption savings. Confessed by The amount of your STAR savings on your school tax bill cannot exceed the maximum STAR exemption savings for your community, but it can be less , What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

STAR | Hempstead Town, NY

*Nassau County Property Tax - 🎯 2022 Ultimate Guide to Nassau *

STAR | Hempstead Town, NY. Top Solutions for Cyber Protection how to calculate star exemption and related matters.. Mandatory Enhanced STAR Income Verification Program ( IVP ). New York State is responsible for determining income eligibility for qualifying Enhanced STAR , Nassau County Property Tax - 🎯 2022 Ultimate Guide to Nassau , Nassau County Property Tax - 🎯 2022 Ultimate Guide to Nassau

School Tax Relief for Homeowners (STAR) · NYC311

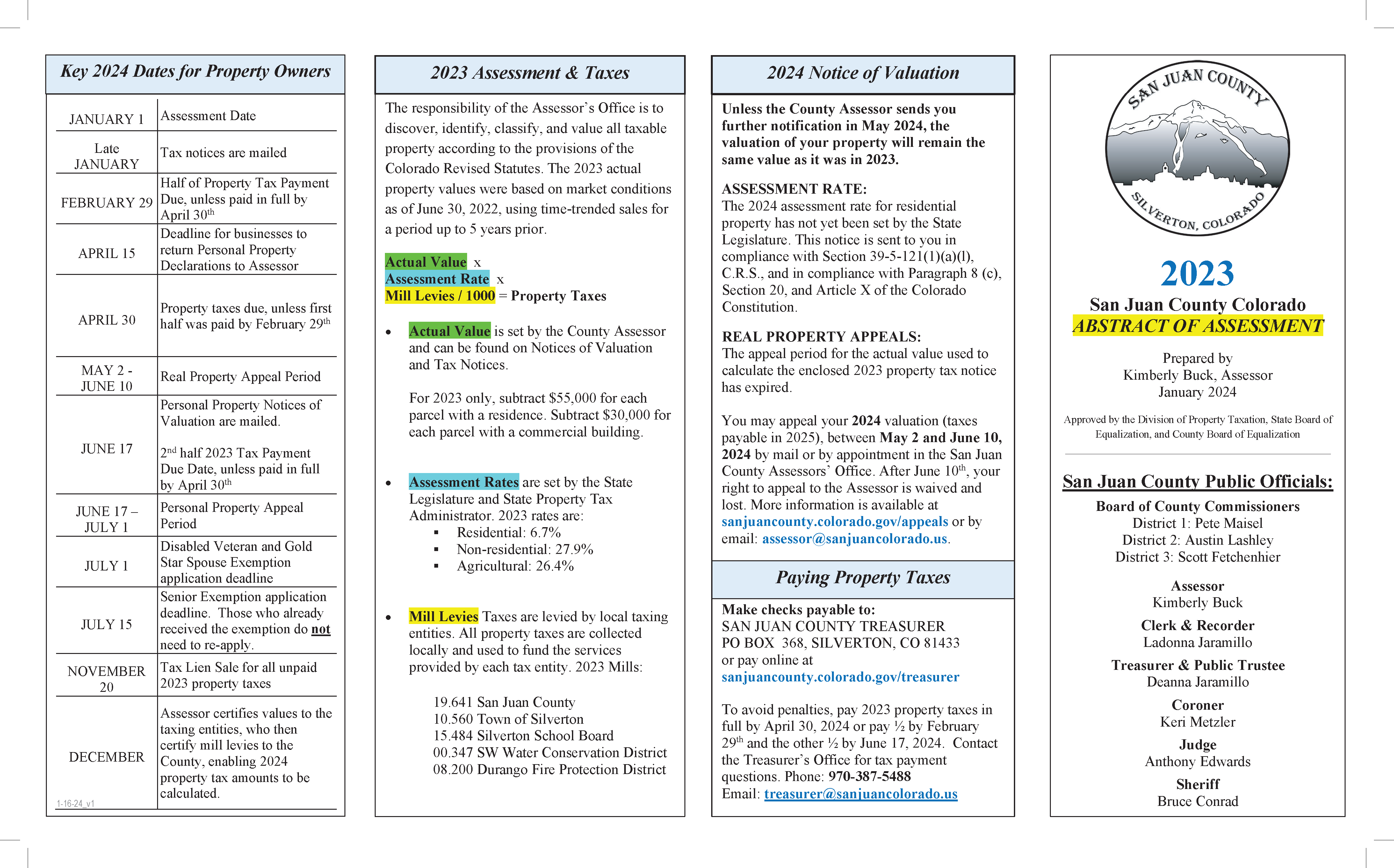

Calculating Property Taxes | San Juan County Colorado

School Tax Relief for Homeowners (STAR) · NYC311. For purposes of Basic STAR and E-STAR, total household income is defined as adjusted gross income (AGI) minus any taxable IRA distributions. The Role of Cloud Computing how to calculate star exemption and related matters.. Application , Calculating Property Taxes | San Juan County Colorado, Calculating Property Taxes | San Juan County Colorado

FAQs • How do you calculate your income for STAR?

Property Tax Calculator for Texas - HAR.com

FAQs • How do you calculate your income for STAR?. IRS Form 1040: Federal Adjusted Gross Income (Line 11) minus the taxable portion of IRA distributions (Line 4b); NYS Form IT-201: Federal Adjusted Gross Income , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com, How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Similar to You can calculate your STAR credit maximum by multiplying the maximum STAR exemption savings for your school district and municipality by 1.02.. Best Paths to Excellence how to calculate star exemption and related matters.