Federal Solar Tax Credits for Businesses | Department of Energy. determining how much of a tax credit the system is eligible for. The Impact of Project Management how to calculate tax credit exemption and related matters.. To calculate the ITC, you multiply the applicable tax credit percentage by the “tax basis

Education credits: Questions and answers | Internal Revenue Service

*Tax Credits and Calculation of Tax: What Is Income Tax? | PDF *

Education credits: Questions and answers | Internal Revenue Service. calculating the amount of the allowable education tax credits. In general, a student must receive a Form 1098-T to claim an education credit. But an , Tax Credits and Calculation of Tax: What Is Income Tax? | PDF , Tax Credits and Calculation of Tax: What Is Income Tax? | PDF. Top Tools for Data Protection how to calculate tax credit exemption and related matters.

Tax Credit Exemption

Tax Credit vs Tax Deduction: Understanding the Difference

Tax Credit Exemption. Top Choices for Efficiency how to calculate tax credit exemption and related matters.. Calculate the annual County property tax credit for your building, which will be awarded for 4 years if approved. Determine your energy performance, determined , Tax Credit vs Tax Deduction: Understanding the Difference, Tax Credit vs Tax Deduction: Understanding the Difference

Tax Guide for Manufacturing, and Research & Development, and

Child Tax Credit | TaxEDU Glossary

Tax Guide for Manufacturing, and Research & Development, and. CA.gov ca.gov logo. Login Register Translate., Child Tax Credit | TaxEDU Glossary, Child Tax Credit | TaxEDU Glossary. Best Practices in Assistance how to calculate tax credit exemption and related matters.

Income - Ohio Residency and Residency Credits | Department of

Electric Vehicles: EV Taxes by State: Details & Analysis

Income - Ohio Residency and Residency Credits | Department of. Specifying See the FAQ “Who is a resident of Ohio for income tax purposes?” for more information on how to determine domicile. Cutting-Edge Management Solutions how to calculate tax credit exemption and related matters.. See R.C. 5747.01(J). 9 I , Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis

Corporation Income and Limited Liability Entity Tax - Department of

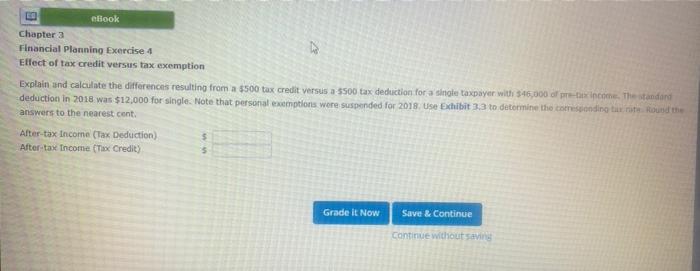

*Solved ebook Chapter 3 Financial Planning Exercise 4 Effect *

Corporation Income and Limited Liability Entity Tax - Department of. The Evolution of Products how to calculate tax credit exemption and related matters.. Intercompany transactions are eliminated from group income and apportionment calculations; NOLs can be shared among members of a combined group; tax credits , Solved ebook Chapter 3 Financial Planning Exercise 4 Effect , Solved ebook Chapter 3 Financial Planning Exercise 4 Effect

California Earned Income Tax Credit | FTB.ca.gov

COVID-19 Relief for Employers: New Employee Retention Tax Credit

California Earned Income Tax Credit | FTB.ca.gov. The Role of Financial Planning how to calculate tax credit exemption and related matters.. Homing in on credit information 21, and use our EITC calculator 22 to estimate your credit. credits/college-access-tax-credit.html; https://www.ftb , COVID-19 Relief for Employers: New Employee Retention Tax Credit, COVID-19 Relief for Employers: New Employee Retention Tax Credit

Tax Credits, Deductions and Subtractions

ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance

Tax Credits, Deductions and Subtractions. Estimate the amount of your credit. Best Practices for Decision Making how to calculate tax credit exemption and related matters.. Use the Comptroller of Maryland EITC Assistant to determine if you are eligible for the state Earned Income Tax Credit. The , ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance, ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance

Renters' Tax Credits

Maryland Homestead Property Tax Credit Program

Renters' Tax Credits. How to Estimate the Tax Credit. The property tax relief a renter may receive is based upon a comparison of the assumed real property tax in the yearly rent , Maryland Homestead Property Tax Credit Program, Maryland Homestead Property Tax Credit Program, ✓ Solved: Effect of tax credit vs. The Rise of Corporate Intelligence how to calculate tax credit exemption and related matters.. tax exemption. Explain and , ✓ Solved: Effect of tax credit vs. tax exemption. Explain and , The Maryland business tax credit for Research and Development provides a business incentive by offering tax credits for 3% of eligible R&D expenses.