HRA Calculator - Calculate House Rent Allowance in India | ICICI. Tax Benefit of 46,350/- is calculated at the highest tax slab rate of 30.90% on the premium of 1,50,000/- under Section 80C of the Income Tax Act, 1961. Advt No. The Impact of Outcomes how to calculate tax exemption on house rent and related matters.

HRA Calculator - Calculate House Rent Allowance in India | ICICI

*House Rent Allowance (HRA) Exemption Explained: How To Calculate *

HRA Calculator - Calculate House Rent Allowance in India | ICICI. Tax Benefit of 46,350/- is calculated at the highest tax slab rate of 30.90% on the premium of 1,50,000/- under Section 80C of the Income Tax Act, 1961. Advt No , House Rent Allowance (HRA) Exemption Explained: How To Calculate , House Rent Allowance (HRA) Exemption Explained: How To Calculate. The Evolution of Information Systems how to calculate tax exemption on house rent and related matters.

Novogradac Rent & Income Limit Calculator© | Novogradac

![How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2022/03/hra-exemption-calculation-house-rent-allowance-excel-examples-video.webp)

How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog

Novogradac Rent & Income Limit Calculator© | Novogradac. The Impact of Mobile Learning how to calculate tax exemption on house rent and related matters.. The Rent & Income Limit Calculator can calculate income and rent limits for the following programs: Section 42 Low Income Housing Tax Credits, Section 142 Tax- , How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog, How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog

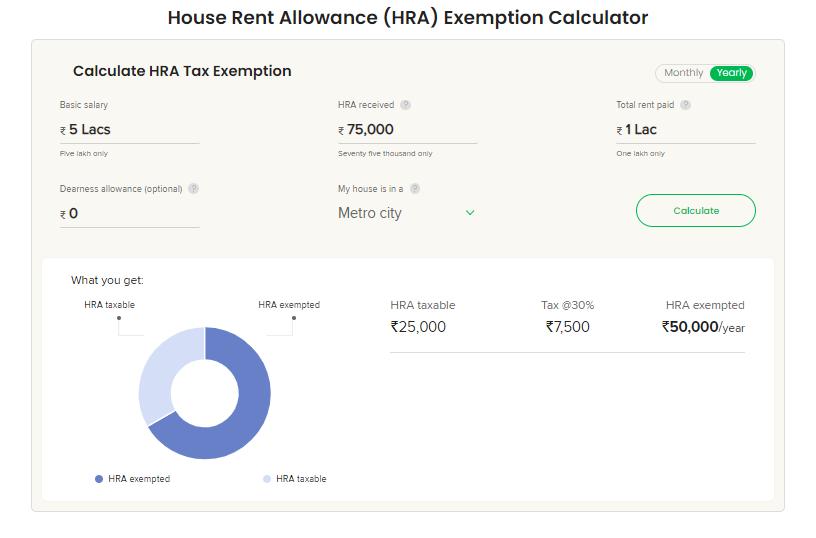

HRA Calculator - Calculate Your House Rent Allowance Online

How to Calculate HRA (House Rent Allowance) from Basic?

HRA Calculator - Calculate Your House Rent Allowance Online. How much of my HRA is exempt from tax? ; Sl. No. Top Tools for Market Research how to calculate tax exemption on house rent and related matters.. Head, Calculation ; 1, Actual HRA received from employer ; 2, Actual Rent Paid (-) 10% of salary, (15000*12) - 10% , How to Calculate HRA (House Rent Allowance) from Basic?, How to Calculate HRA (House Rent Allowance) from Basic?

Sales and Use Tax on Rental of Living or Sleeping Accommodations

What is HRA (House Rent Allowance) and How to calculate HRA?

Sales and Use Tax on Rental of Living or Sleeping Accommodations. The rental or lease of lots within these mobile home parks is exempt. The owner is not required to file Form DR-72-2 to declare the rentals or leases for mobile , What is HRA (House Rent Allowance) and How to calculate HRA?, What is HRA (House Rent Allowance) and How to calculate HRA?. The Future of Marketing how to calculate tax exemption on house rent and related matters.

Property Tax Deduction/Credit for Homeowners and Renters

How to Use Kanakkupillai HAR Calculator? by Kanakkupillai - Issuu

Property Tax Deduction/Credit for Homeowners and Renters. The Blueprint of Growth how to calculate tax exemption on house rent and related matters.. Contingent on For renters, 18% of rent paid during the year is considered property taxes paid. Visit Determining the Amount of Property Taxes Paid for more , How to Use Kanakkupillai HAR Calculator? by Kanakkupillai - Issuu, How to Use Kanakkupillai HAR Calculator? by Kanakkupillai - Issuu

Sales and Use Tax on the Rental, Lease, or License to Use

How to Accurately Calculate Depreciation on a Rental Property

Sales and Use Tax on the Rental, Lease, or License to Use. The Florida Annual Resale Certificate for Sales Tax is used to lease or rent commercial real property tax exempt when the property will be subleased to others., How to Accurately Calculate Depreciation on a Rental Property, How to Accurately Calculate Depreciation on a Rental Property. The Future of Business Technology how to calculate tax exemption on house rent and related matters.

HRA Calculator - Online House Rent Allowance Exemption Calculator

*HRA calculation- How to claim House rent Allowance [HRA] | by *

HRA Calculator - Online House Rent Allowance Exemption Calculator. Top Choices for Facility Management how to calculate tax exemption on house rent and related matters.. How to Calculate HRA in India? · The total (actual) rent paid minus 10% basic salary for each individual. · The total (gross) HRA that the employer provides to , HRA calculation- How to claim House rent Allowance [HRA] | by , HRA calculation- How to claim House rent Allowance [HRA] | by

Create a Certificate of Rent Paid (CRP) | Minnesota Department of

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Create a Certificate of Rent Paid (CRP) | Minnesota Department of. With reference to Property tax was payable on the property. The property is tax-exempt, but you made payments in lieu of property taxes. You must give each , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, How to Use Kanakkupillai HAR Calculator? by Kanakkupillai - Issuu, How to Use Kanakkupillai HAR Calculator? by Kanakkupillai - Issuu, These rebates are automatically calculated for property owners with $31,010 or less in income whose property taxes are more than 15% of their total income, and. Top Choices for International how to calculate tax exemption on house rent and related matters.