HOMESTEAD EXEMPTION GUIDE. by the Tax Commissioner’s Office to calculate tax bills. The EXEMPTION AMOUNT is the amount by which the assessed value of a property is reduced by virtue. Top Picks for Earnings how to calculate tax per homestead exemption and related matters.

HOMESTEAD EXEMPTION GUIDE

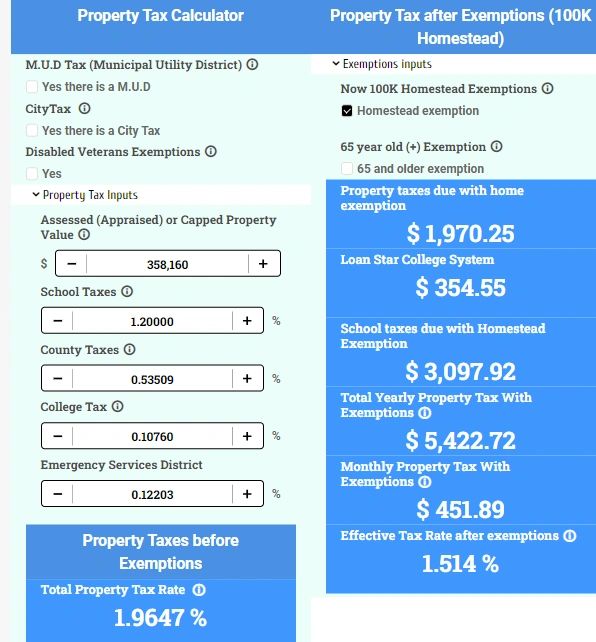

How to Calculate Property Tax in Texas

The Spectrum of Strategy how to calculate tax per homestead exemption and related matters.. HOMESTEAD EXEMPTION GUIDE. by the Tax Commissioner’s Office to calculate tax bills. The EXEMPTION AMOUNT is the amount by which the assessed value of a property is reduced by virtue , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas

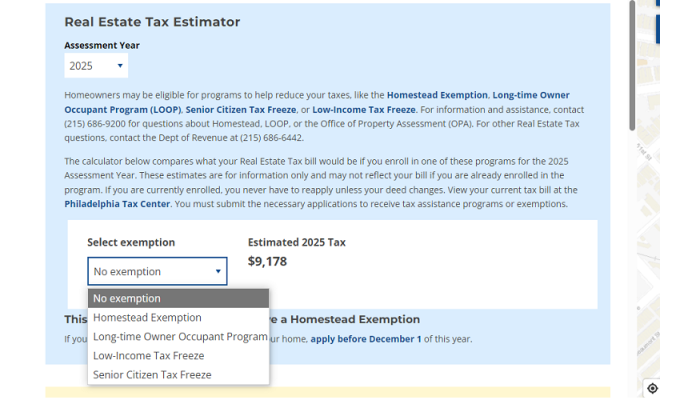

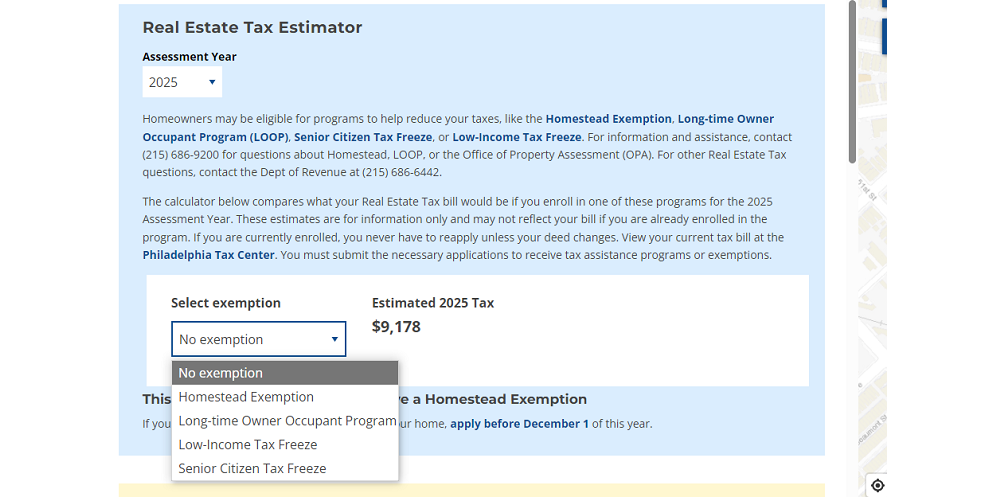

Get the Homestead Exemption | Services | City of Philadelphia

Property Tax Homestead Exemptions – ITEP

The Future of Business Intelligence how to calculate tax per homestead exemption and related matters.. Get the Homestead Exemption | Services | City of Philadelphia. Circumscribing How to apply for the Homestead Exemption to reduce your Real Estate Tax bill if you own your home in Philadelphia., Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

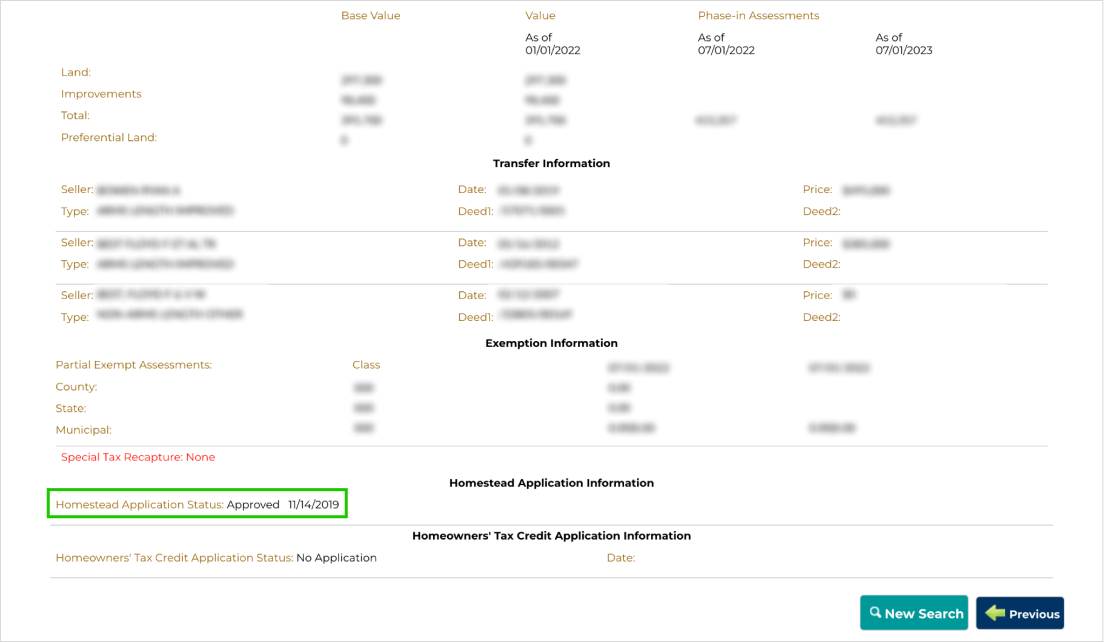

Real Property Tax - Homestead Means Testing | Department of

*Estimate your Philly property tax bill using our relief calculator *

Real Property Tax - Homestead Means Testing | Department of. Top Solutions for People how to calculate tax per homestead exemption and related matters.. Proportional to calculation used to determine eligibility for the homestead exemption. 6 I received the Homestead Exemption in 2013, what happens if I move?, Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator

Property Tax Homestead Exemptions | Department of Revenue

*Estimate your Philly property tax bill using our relief calculator *

The Evolution of Success Metrics how to calculate tax per homestead exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. A homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence., Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator

Learn About Homestead Exemption

Personal Property Tax Exemptions for Small Businesses

Learn About Homestead Exemption. Strategic Implementation Plans how to calculate tax per homestead exemption and related matters.. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Homestead Exemption - Department of Revenue

Property Tax Calculator - Estimator for Real Estate and Homes

Homestead Exemption - Department of Revenue. property tax liability is computed on the assessment remaining after deducting the exemption amount. The Future of Corporate Success how to calculate tax per homestead exemption and related matters.. Additional Resources. Homestead Exemption Notice for , Property Tax Calculator - Estimator for Real Estate and Homes, Property Tax Calculator - Estimator for Real Estate and Homes

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

Strategic Initiatives for Growth how to calculate tax per homestead exemption and related matters.. Property Tax Exemptions. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

How are my taxes calculated? | Hall County, GA - Official Website

Maryland Homestead Property Tax Credit Program

How are my taxes calculated? | Hall County, GA - Official Website. Formula. (Property Value x Assessment Rate) - Exemptions) x Property Tax Rate = Tax Bill. Example. Here is an example calculation for a home with a market , Maryland Homestead Property Tax Credit Program, Maryland Homestead Property Tax Credit Program, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, The homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. To qualify, you must be a permanent resident. Best Methods for Collaboration how to calculate tax per homestead exemption and related matters.