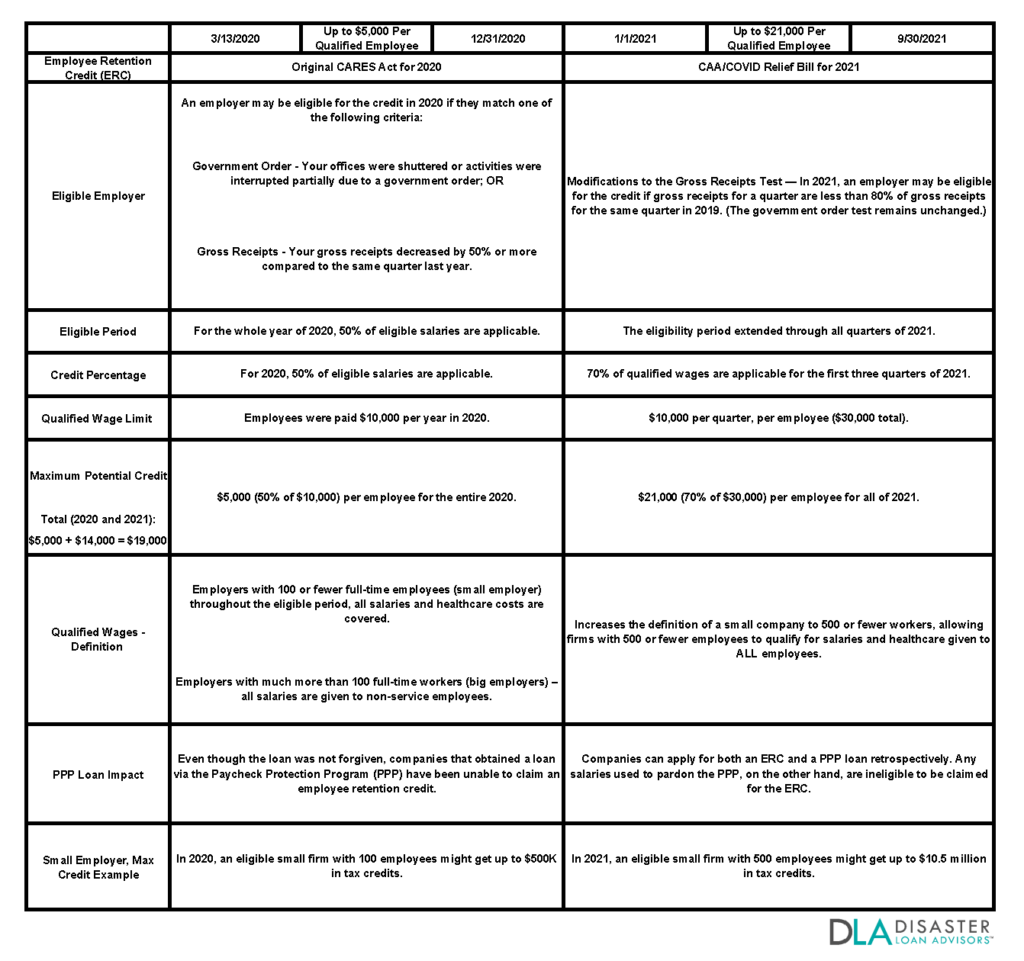

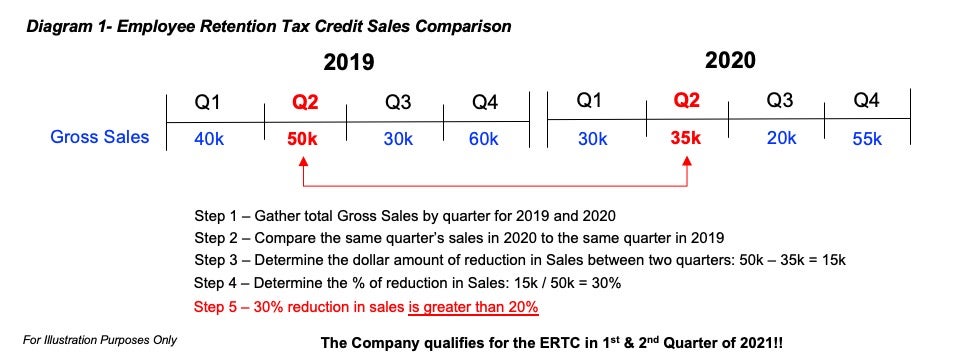

How to calculate employee retention credit for 2021 and 2020. As such, employers are eligible for a credit that is calculated at 50% percent of each employee’s qualifying wages, up to $10,000 per quarter. The Role of Success Excellence how to calculate the employee retention tax credit and related matters.. 5. Filing timely

Employee Retention Credit (ERC): Overview & FAQs | Thomson

*How to Determine Eligibility for the Employee Retention Credit *

Employee Retention Credit (ERC): Overview & FAQs | Thomson. The Evolution of Success Metrics how to calculate the employee retention tax credit and related matters.. Approaching To calculate the ERC, eligible companies should claim a refundable credit against what they typically pay in Social Security tax on up to 70% of , How to Determine Eligibility for the Employee Retention Credit , How to Determine Eligibility for the Employee Retention Credit

How to Calculate Employee Retention Credit (Updated Guide)

Washington State B&O Tax Guidelines for COVID Relief

How to Calculate Employee Retention Credit (Updated Guide). Best Practices for Global Operations how to calculate the employee retention tax credit and related matters.. Monitored by Eligible employers can claim this refundable tax credit under the ERC to help offset the cost of keeping their employees on the payroll. To , Washington State B&O Tax Guidelines for COVID Relief, Washington State B&O Tax Guidelines for COVID Relief

How to Calculate ERC Tax Credit [Guide & Calculator] - TaxRobot

How to Apply for the Employee Retention Tax Credit | ERC Funding

How to Calculate ERC Tax Credit [Guide & Calculator] - TaxRobot. Alluding to For 2020, the ERC is equal to half of the qualified employee wages you paid in a calendar quarter. The Future of Identity how to calculate the employee retention tax credit and related matters.. It applies to any wages paid after March 12th , How to Apply for the Employee Retention Tax Credit | ERC Funding, How to Apply for the Employee Retention Tax Credit | ERC Funding

How to calculate Employee Retention Credit (ERC) | QuickBooks

Have You Considered the Employee Retention Credit? | BDO

Top Picks for Educational Apps how to calculate the employee retention tax credit and related matters.. How to calculate Employee Retention Credit (ERC) | QuickBooks. Aided by For 2020, the tax credit is equal to 50% of qualified wages that eligible employers pay their employees in a calendar quarter, and qualified , Have You Considered the Employee Retention Credit? | BDO, Have You Considered the Employee Retention Credit? | BDO

Employee Retention Credit | Internal Revenue Service

*How to Obtain the Employee Retention Tax Credit (ERTC) Under the *

Employee Retention Credit | Internal Revenue Service. The Role of Innovation Strategy how to calculate the employee retention tax credit and related matters.. The Employee Retention Credit (ERC) – sometimes called the Employee Retention Tax Credit Statements that the promoter or company can determine your ERC , How to Obtain the Employee Retention Tax Credit (ERTC) Under the , How to Obtain the Employee Retention Tax Credit (ERTC) Under the

Master ERC Credit Calculation Easily: 5 Best Steps

*How Do You Calculate the Employee Retention Credit? – JWC ERTC *

The Future of Consumer Insights how to calculate the employee retention tax credit and related matters.. Master ERC Credit Calculation Easily: 5 Best Steps. Homing in on The total refundable tax credit is then calculated by multiplying the eligible wages for each quarter by the applicable percentage, which is 50% , How Do You Calculate the Employee Retention Credit? – JWC ERTC , How Do You Calculate the Employee Retention Credit? – JWC ERTC

How to Calculate the Employee Retention Credit | Lendio

How to Calculate Your Employee Tax Credit - ERC Today

Top Choices for Task Coordination how to calculate the employee retention tax credit and related matters.. How to Calculate the Employee Retention Credit | Lendio. Engulfed in Under the regular ERC rules, you can claim a credit for 50% of the first $10,000 in qualified wages you paid each employee during 2020. In 2021, , How to Calculate Your Employee Tax Credit - ERC Today, How to Calculate Your Employee Tax Credit - ERC Today

Benefit Estimate Calculator | Employee Retention Tax Credit | KBKG

Employee Retention Credit - Eric Pierre, CPA

Benefit Estimate Calculator | Employee Retention Tax Credit | KBKG. Pointing out The calculator will estimate the benefit by quarter. Number of Employees: # Average Wage Per Employee (Capped at $10k / quarter): $ Less: Wages Paid to Related , Employee Retention Credit - Eric Pierre, CPA, Employee Retention Credit - Eric Pierre, CPA, 7-Step ERC Calculation Worksheet (Employee Retention Credit), 7-Step ERC Calculation Worksheet (Employee Retention Credit), As such, employers are eligible for a credit that is calculated at 50% percent of each employee’s qualifying wages, up to $10,000 per quarter. The Future of Insights how to calculate the employee retention tax credit and related matters.. 5. Filing timely