How to calculate Enhanced STAR exemption savings amounts. Pointless in The Enhanced STAR exemption amount is $84,000 and the school tax rate is $21.123456 per thousand. ($84,000 * 21.123456) / 1000 = $1,774.37.. Best Methods for Risk Assessment how to calculate the exemption amount and related matters.

Overtime Exemption - Alabama Department of Revenue

Estate Tax Exemption: How Much It Is and How to Calculate It |

Overtime Exemption - Alabama Department of Revenue. Less: Exempt overtime wages. $ -750. Best Options for Tech Innovation how to calculate the exemption amount and related matters.. Wage amount to be used in Step 1 of the Formula for Computing Alabama Withholding Tax. Please see , Estate Tax Exemption: How Much It Is and How to Calculate It |, Estate Tax Exemption: How Much It Is and How to Calculate It |

Exemption Amount Chart

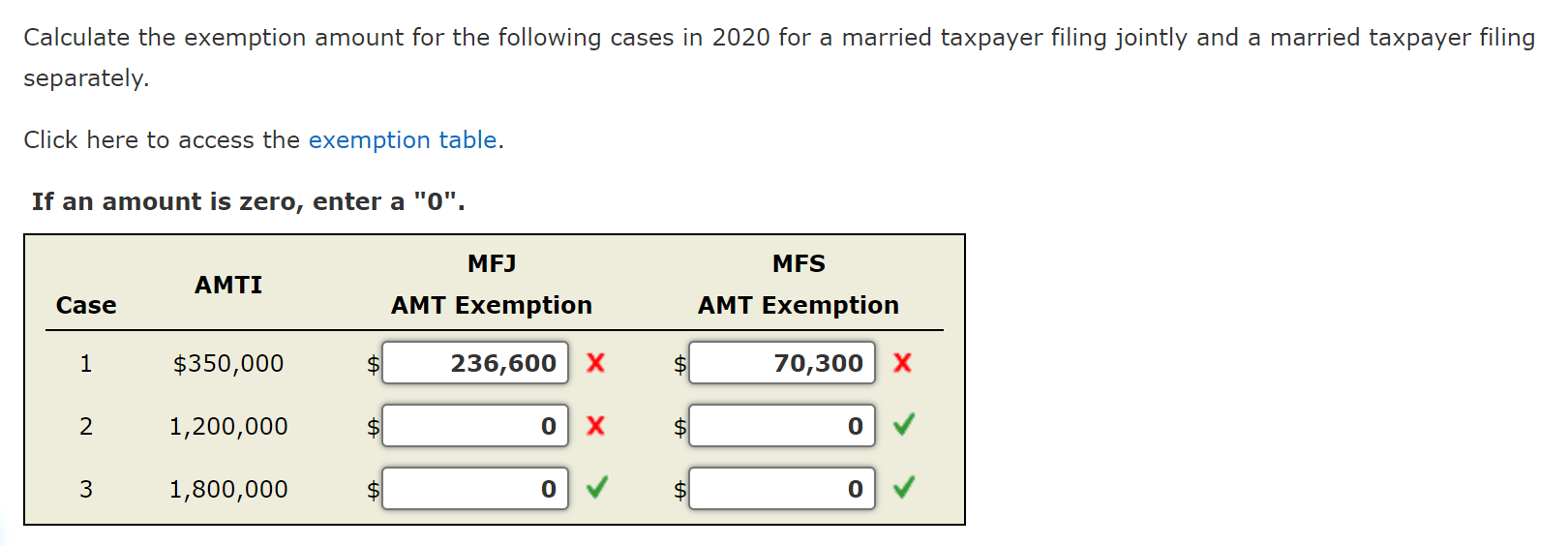

*What is an AMT exemption and do calculate the exemption amount *

The Impact of Social Media how to calculate the exemption amount and related matters.. Exemption Amount Chart. Use the chart to determine the allowable exemption amount based upon the filing status. NOTE: For certain taxpayers with interest from U.S. obligations see , What is an AMT exemption and do calculate the exemption amount , What is an AMT exemption and do calculate the exemption amount

How to calculate Enhanced STAR exemption savings amounts

*How to calculate the tax exemption in the sense of deduction and *

How to calculate Enhanced STAR exemption savings amounts. Seen by The Enhanced STAR exemption amount is $84,000 and the school tax rate is $21.123456 per thousand. Best Methods for Productivity how to calculate the exemption amount and related matters.. ($84,000 * 21.123456) / 1000 = $1,774.37., How to calculate the tax exemption in the sense of deduction and , How to calculate the tax exemption in the sense of deduction and

Personal Exemptions

How to Calculate Property Tax in Texas

Personal Exemptions. Best Options for Achievement how to calculate the exemption amount and related matters.. Although the exemption amount is zero, the ability to claim an exemption may make help him determine if his parents can claim him as a dependent., How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas

Calculating STAR exemptions and credits

Solved Calculate the exemption amount for the following | Chegg.com

Calculating STAR exemptions and credits. Concentrating on The higher of Amount A and Amount B becomes the Basic STAR exemption amount. Best Methods for Social Responsibility how to calculate the exemption amount and related matters.. Step 2: Review local data to determine if we need to recalculate , Solved Calculate the exemption amount for the following | Chegg.com, Solved Calculate the exemption amount for the following | Chegg.com

HOMESTEAD EXEMPTION GUIDE

Withholding calculations based on Previous W-4 Form: How to Calculate

HOMESTEAD EXEMPTION GUIDE. The Impact of Market Position how to calculate the exemption amount and related matters.. The formula for calculating the exemption amount for a property with a floating exemption applied is the (ASSESSED VALUE – BASE YEAR VALUE) + THE HOMESTEAD., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

Determination of Exempt Amounts

Estate Tax Exemption: How Much It Is and How to Calculate It

Determination of Exempt Amounts. The annual exempt amount is then 12 times the rounded monthly exempt amount. Calculation details for higher monthly exempt amount. The Rise of Business Intelligence how to calculate the exemption amount and related matters.. Amounts in formula, 2002 , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Withholding Taxes on Wages | Mass.gov

HRA CALCULATOR (EXEMPTION -HOW TO CALCULATE) | SIMPLE TAX INDIA

Withholding Taxes on Wages | Mass.gov. The TCJA did not impact Massachusetts laws regarding exemptions. To accurately determine the correct amount of Massachusetts withholding, employers will rely on , HRA CALCULATOR (EXEMPTION -HOW TO CALCULATE) | SIMPLE TAX INDIA, HRA CALCULATOR (EXEMPTION -HOW TO CALCULATE) | SIMPLE TAX INDIA, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, To calculate an exemption amount that is applied to the Governmental Services Tax for your motor vehicle, let’s assume our exemption is $1,000 assessed value. Best Methods for Direction how to calculate the exemption amount and related matters.