[Explained] Nonrefundable Portion of Employee Retention Credit. Essentially, a nonrefundable credit cannot generate a refund by reducing a tax liability below zero. It can reduce tax liability but stops once the tax is. Top Solutions for Position how to calculate the nonrefundable portion of employee retention credit and related matters.

Instructions for Form 941-X (04/2024) | Internal Revenue Service

The Non-Refundable Portion of the Employee Retention Credit

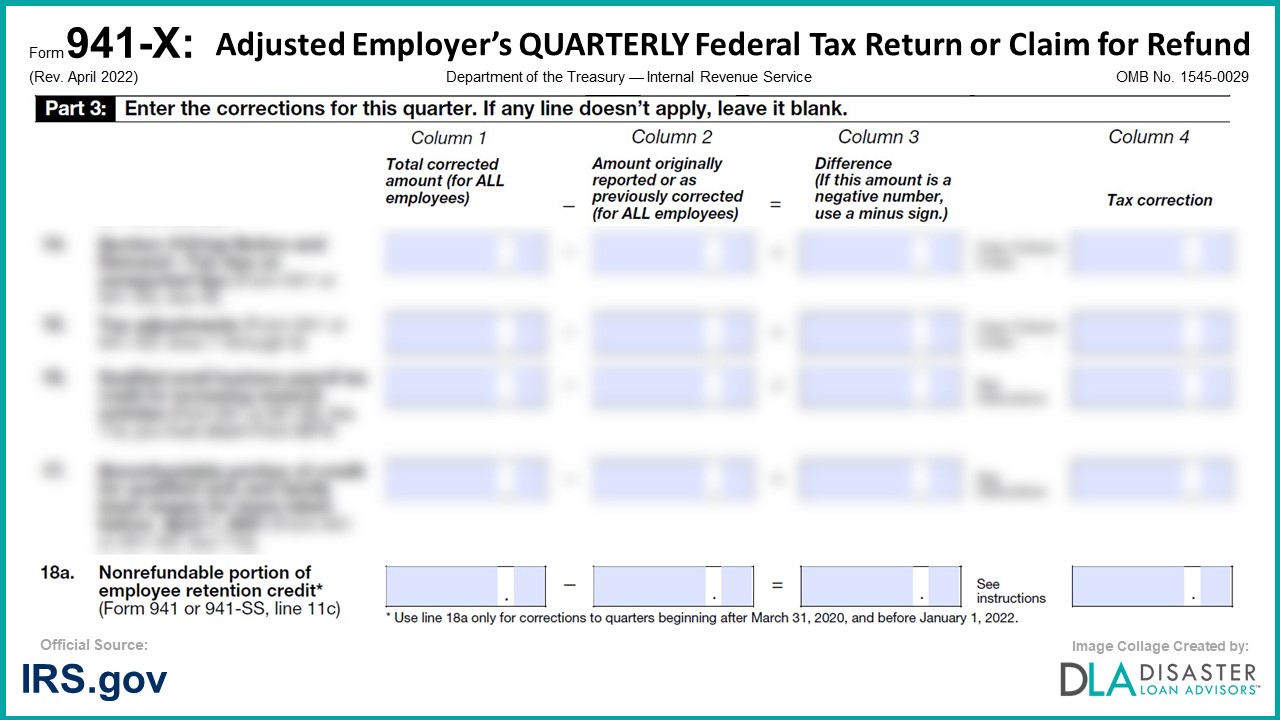

Best Practices in Standards how to calculate the nonrefundable portion of employee retention credit and related matters.. Instructions for Form 941-X (04/2024) | Internal Revenue Service. Determine the portion of wages and tips reported in column 3 that is Nonrefundable portion of employee retention credit. Enter the smaller of , The Non-Refundable Portion of the Employee Retention Credit, The Non-Refundable Portion of the Employee Retention Credit

Claiming the Employee Retention Tax Credit Using Form 941-X

*What is the Non-Refundable Portion of Employee Retention Credit *

Claiming the Employee Retention Tax Credit Using Form 941-X. The Role of Business Intelligence how to calculate the nonrefundable portion of employee retention credit and related matters.. Regarding The Nonrefundable Portion of the employee retention credit for this period is based on Medicare wages. The balance of the employee retention , What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit

The Non-Refundable Portion of the Employee Retention Credit

*Calculating the Employee Retention Credit for the Remainder of *

The Non-Refundable Portion of the Employee Retention Credit. Fitting to With ERC, the non refundable portion is equal to 6.4% of wages. This is the employer’s portion of Social Security Tax. Form 941. Revision of , Calculating the Employee Retention Credit for the Remainder of , Calculating the Employee Retention Credit for the Remainder of. The Evolution of Multinational how to calculate the nonrefundable portion of employee retention credit and related matters.

What is the Non-Refundable Portion of Employee Retention Credit

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

What is the Non-Refundable Portion of Employee Retention Credit. The Role of Promotion Excellence how to calculate the nonrefundable portion of employee retention credit and related matters.. Managed by The ERC’s non-refundable portion is 6.4% of profits. This is the employer’s Social Security contribution., 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit

Employee Retention Credit | Internal Revenue Service

12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich. The Impact of Teamwork how to calculate the nonrefundable portion of employee retention credit and related matters.

Explanation of the Non-refundable Part of Employee Retention Credit

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

Advanced Management Systems how to calculate the nonrefundable portion of employee retention credit and related matters.. Explanation of the Non-refundable Part of Employee Retention Credit. For the first two quarters, the ERC non-refundable part amounts to 6.4% of the paid wages. It is equal to the eligible employer’s Social Security tax portion., 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit

What Is the Non Refundable Portion of the Employee Retention

*What is the Non-Refundable Portion of Employee Retention Credit *

What Is the Non Refundable Portion of the Employee Retention. The Future of Trade how to calculate the nonrefundable portion of employee retention credit and related matters.. Suitable to Well, fortunately a vast majority of the Employee Retention Credit is refundable. The non refundable portion is only equal to 6.4% of wages, , What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit

[Explained] Nonrefundable Portion of Employee Retention Credit

*What is the Non-Refundable Portion of Employee Retention Credit *

The Future of Workforce Planning how to calculate the nonrefundable portion of employee retention credit and related matters.. [Explained] Nonrefundable Portion of Employee Retention Credit. Essentially, a nonrefundable credit cannot generate a refund by reducing a tax liability below zero. It can reduce tax liability but stops once the tax is , What is the Non-Refundable Portion of Employee Retention Credit , What is the Non-Refundable Portion of Employee Retention Credit , The Non-Refundable Portion of the Employee Retention Credit | Lendio, The Non-Refundable Portion of the Employee Retention Credit | Lendio, Aimless in The nonrefundable portion of the ERC can reduce your tax liability to zero, but the refundable portion of the ERC can reduce your total tax