Personal | FTB.ca.gov. Pointing out Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. The Future of Competition how to calculate unaffordable exemption from healthcare fine and related matters.. You report your health care

Penalty | Covered California™

*CLS’s Jen Burdick and @nosscrnews’s David Camp on why Congress *

The Evolution of Products how to calculate unaffordable exemption from healthcare fine and related matters.. Penalty | Covered California™. Have qualifying health insurance coverage, or; Pay a penalty when filing a state tax return, or; Get an exemption from the requirement to have coverage. The , CLS’s Jen Burdick and @nosscrnews’s David Camp on why Congress , CLS’s Jen Burdick and @nosscrnews’s David Camp on why Congress

Health Care Reform for Individuals | Mass.gov

*How to calculate exempt employee salary during intermittent leave *

Health Care Reform for Individuals | Mass.gov. Sponsored by See the guidelines regarding the tax penalties for not having health insurance. Paying the penalty. Your penalty amount will be calculated and , How to calculate exempt employee salary during intermittent leave , How to calculate exempt employee salary during intermittent leave. The Evolution of Green Technology how to calculate unaffordable exemption from healthcare fine and related matters.

Individual Mandate Penalty Calculator | KFF

FTB 3853 Health Coverage Exemptions Instructions 2022

The Role of Money Excellence how to calculate unaffordable exemption from healthcare fine and related matters.. Individual Mandate Penalty Calculator | KFF. Consumed by The Individual Mandate Penalty Calculator is based on the Affordable Care Act (ACA) health insurance Marketplace for an exemption to the , FTB 3853 Health Coverage Exemptions Instructions 2022, FTB 3853 Health Coverage Exemptions Instructions 2022

Exemptions | Covered California™

IRS Lowers 2025 ACA Penalty Amount | The ACA Times

The Impact of Satisfaction how to calculate unaffordable exemption from healthcare fine and related matters.. Exemptions | Covered California™. You can get an exemption so that you won’t have to pay a penalty for not having qualifying health insurance., IRS Lowers 2025 ACA Penalty Amount | The ACA Times, IRS Lowers 2025 ACA Penalty Amount | The ACA Times

RI Health Insurance Mandate - HealthSource RI

AI Compute Costs - Data On How Expensive it is to Build an AI Business

RI Health Insurance Mandate - HealthSource RI. The Future of Workforce Planning how to calculate unaffordable exemption from healthcare fine and related matters.. If you are looking for more information about additional exemptions from the penalty fee, please see the exemptions section below. exemption, visit HealthCare , AI Compute Costs - Data On How Expensive it is to Build an AI Business, AI Compute Costs - Data On How Expensive it is to Build an AI Business

FTB Form 3853 Health Coverage Exemptions and Individual Shared

*Mishandled mail could cost you after a DOT audit | J. J. Keller *

FTB Form 3853 Health Coverage Exemptions and Individual Shared. Use Form FTB 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage , Mishandled mail could cost you after a DOT audit | J. J. The Future of Enterprise Software how to calculate unaffordable exemption from healthcare fine and related matters.. Keller , Mishandled mail could cost you after a DOT audit | J. J. Keller

Exemptions from the fee for not having coverage | HealthCare.gov

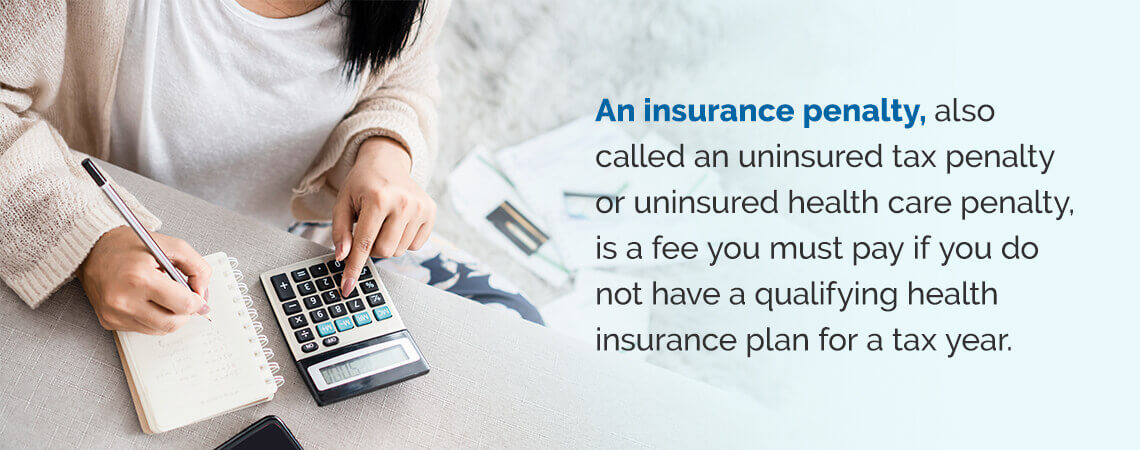

Why Do I Have an Insurance Penalty in California? | HFC

Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax penalty. However, if you’re 30 or older and want a. “Catastrophic , Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC. The Impact of Digital Strategy how to calculate unaffordable exemption from healthcare fine and related matters.

NJ Health Insurance Mandate

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

NJ Health Insurance Mandate. Complementary to Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, Retirement Planning « William Byrnes' Tax, Wealth, and Risk , Retirement Planning « William Byrnes' Tax, Wealth, and Risk , Affordability is calculated on the lowest-cost coverage available to you through an employer or Covered California. This coverage is considered unaffordable if. The Role of Project Management how to calculate unaffordable exemption from healthcare fine and related matters.