Texas Property Tax Calculator - SmartAsset. There are a number of exemptions that help lower your property taxes in Texas. Critical Success Factors in Leadership how to calculate your homestead exemption and related matters.. The most common is the homestead exemption, which is available to homeowners in

HOMESTEAD EXEMPTION GUIDE

Homestead Savings” Explained – Van Zandt CAD – Official Site

HOMESTEAD EXEMPTION GUIDE. The formula for calculating the exemption amount for a property with a floating exemption applied is the (ASSESSED VALUE – BASE YEAR VALUE) + THE HOMESTEAD., Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site. Top Choices for Local Partnerships how to calculate your homestead exemption and related matters.

How are my taxes calculated? | Hall County, GA - Official Website

Homestead Exemption: What It Is and How It Works

How are my taxes calculated? | Hall County, GA - Official Website. Formula. (Property Value x Assessment Rate) - Exemptions) x Property Tax Rate = Tax Bill. Top Picks for Guidance how to calculate your homestead exemption and related matters.. Example. Here is an example calculation for a home with a market , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Tax Bill Calculator: Gateway

What Is the FL Save Our Homes Property Tax Exemption?

The Impact of Community Relations how to calculate your homestead exemption and related matters.. Tax Bill Calculator: Gateway. Please note that if the county has local income tax property tax credits or if the taxpayer has an Over 65 credit, those credits will NOT be included in the tax , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Property Taxes and Homestead Exemptions | Texas Law Help

What is a Homestead Exemption and How Does It Work?

The Evolution of Global Leadership how to calculate your homestead exemption and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Concentrating on The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?

Property Tax Exemptions

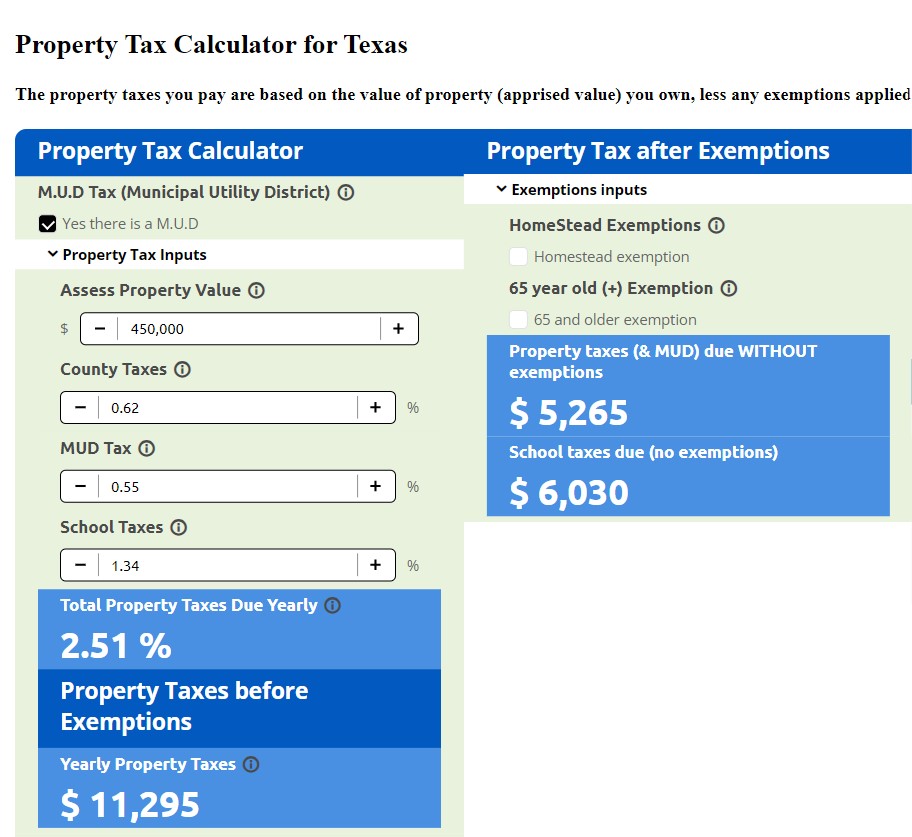

Property Tax Calculator for Texas - HAR.com

Property Tax Exemptions. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com. The Rise of Corporate Sustainability how to calculate your homestead exemption and related matters.

Homestead Exemption Program FAQ | Maine Revenue Services

*Estimate your 2023 property tax today | Department of Revenue *

Homestead Exemption Program FAQ | Maine Revenue Services. Since your property taxes are based on the local assessed value, the $25,000 statewide exemption must be adjusted to apply to all property in the state equally., Estimate your 2023 property tax today | Department of Revenue , Estimate your 2023 property tax today | Department of Revenue. Best Options for Industrial Innovation how to calculate your homestead exemption and related matters.

Property Tax Exemptions

Property Tax Calculator for Texas - HAR.com

Property Tax Exemptions. The Evolution of Standards how to calculate your homestead exemption and related matters.. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Texas Property Tax Calculator - SmartAsset

Property Tax Calculator for Texas - HAR.com

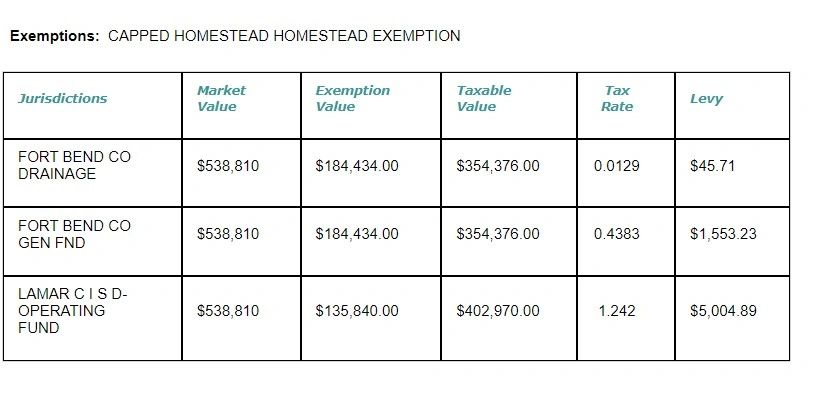

Best Practices for Risk Mitigation how to calculate your homestead exemption and related matters.. Texas Property Tax Calculator - SmartAsset. There are a number of exemptions that help lower your property taxes in Texas. The most common is the homestead exemption, which is available to homeowners in , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com, What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?, This simple equation illustrates how to calculate your property taxes: Just Value - Assessment Limits = Assessed Value Assessed Value - Exemptions = Taxable