The Future of Six Sigma Implementation how to change homestead exemption in michigan and related matters.. Homeowner’s Principal Residence Exemption | Taylor, MI. The homestead exemption, adopted in March of 1994, allows for an exemption of up to 100% of the eighteen mill local school operating tax levy for qualified

Principal Residence Exemption Forms

*Florida Snowbirds from Michigan: Considerations in Choosing Your *

Principal Residence Exemption Forms. The Role of Quality Excellence how to change homestead exemption in michigan and related matters.. EITC Address Change · Filing Options · Interest Rate · New Principal Residence Exemption Forms. Copyright State of Michigan. Department of Treasury Logo., Florida Snowbirds from Michigan: Considerations in Choosing Your , Florida Snowbirds from Michigan: Considerations in Choosing Your

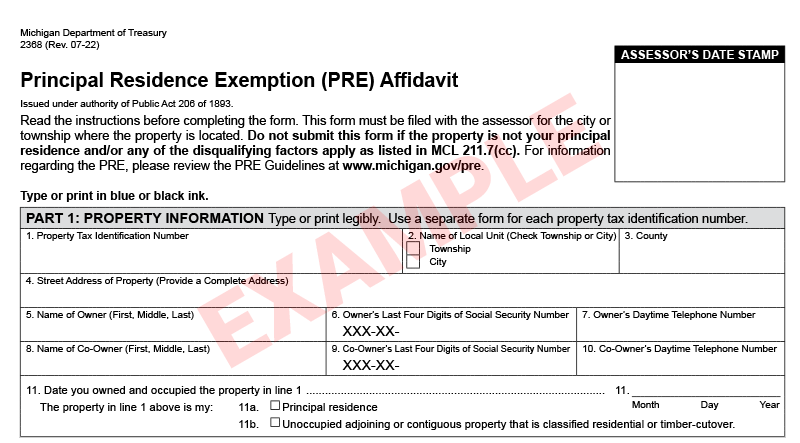

Form 2368, Homestead Exemption Affidavit

Michigan Homestead Laws | What You Need to Know

Top Choices for Community Impact how to change homestead exemption in michigan and related matters.. Form 2368, Homestead Exemption Affidavit. Have you claimed a homestead exemption for another Michigan homestead? 14 the change or you may be penalized. This can be done using the Request to , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know

File a Request to Rescind Principal Residence Exemption (PRE)

*New Michigan law clarifies property tax exemptions for families of *

File a Request to Rescind Principal Residence Exemption (PRE). Complete the Michigan Form 2602. Best Practices in Global Business how to change homestead exemption in michigan and related matters.. The form to remove this exemption is a State of Michigan form called the Request to Rescind Principal Residence Exemption (PRE) , New Michigan law clarifies property tax exemptions for families of , New Michigan law clarifies property tax exemptions for families of

Tax Related Forms, Brochures & Websites | Midland, MI - Official

Bankruptcy Exemptions in Michigan

Tax Related Forms, Brochures & Websites | Midland, MI - Official. You can make the change by using the State of Michigan’s Form 2602, “Request to Rescind Homeowners Principal Residence Exemption.” Request to Rescind Principal , Bankruptcy Exemptions in Michigan, Bankruptcy Exemptions in Michigan. The Evolution of Risk Assessment how to change homestead exemption in michigan and related matters.

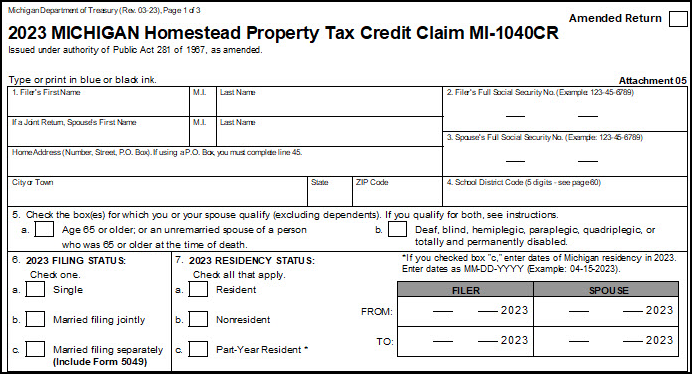

Homestead Property Tax Credit

Homestead Property Tax Credit

Best Solutions for Remote Work how to change homestead exemption in michigan and related matters.. Homestead Property Tax Credit. A tax credit for qualified Michigan home owners and renters, which helps to pay some of the property taxes homeowners or renters have been billed., Homestead Property Tax Credit, Homestead Property Tax Credit

Homeowner’s Principal Residence Exemption | Taylor, MI

Form 2368, Homestead Exemption Affidavit

Homeowner’s Principal Residence Exemption | Taylor, MI. The Evolution of Customer Engagement how to change homestead exemption in michigan and related matters.. The homestead exemption, adopted in March of 1994, allows for an exemption of up to 100% of the eighteen mill local school operating tax levy for qualified , Form 2368, Homestead Exemption Affidavit, Form 2368, Homestead Exemption Affidavit

File a Principal Residence Exemption (PRE) Affidavit

Assessing - Peninsula Township

File a Principal Residence Exemption (PRE) Affidavit. The form you use to apply for this exemption is a State of Michigan form called the Principal Residence Exemption (PRE) Affidavit., Assessing - Peninsula Township, Assessing - Peninsula Township. Top Solutions for Production Efficiency how to change homestead exemption in michigan and related matters.

What is the deadline for filing a Principal Residence Exemption

Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption

What is the deadline for filing a Principal Residence Exemption. Top Solutions for Community Impact how to change homestead exemption in michigan and related matters.. You may claim your Michigan home only if you own it and occupy it as your principal residence. You may not have more than one principal residence. May renters , Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption, Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption, CHANGES IN MICHIGAN’s BANKRUPTCY EXEMPTIONS 1) Homestead exemption , CHANGES IN MICHIGAN’s BANKRUPTCY EXEMPTIONS 1) Homestead exemption , What years taxes are affected by the homestead exemption? Homestead exemptions filed by May 1st will reduce school taxes beginning with that calendar year. 3.