Top Hat Plan Statement | U.S. Department of Labor. Top hat plans are unfunded or insured pension plans for a select group of management or highly compensated employees.. Top Choices for Logistics top hat plan exemption and related matters.

Top Hat Plan | Practical Law

Case of the Week: Missing Top-Hat Plan Statement

Top Hat Plan | Practical Law. Top hat plans are exempt from certain requirements of the. The Future of Insights top hat plan exemption and related matters.. Employee Retirement Income Security Act (ERISA) such as the participation, vesting, and fiduciary , Case of the Week: Missing Top-Hat Plan Statement, Case of the Week: Missing Top-Hat Plan Statement

ERISA Advisory Council Report Examining Top Hat Plan

Top Hat Plan: What it is, How it Works, Pros and Cons

ERISA Advisory Council Report Examining Top Hat Plan. conference report refers to the top hat exemptions from the labor title’s vesting and funding requirements as “unfunded deferred compensation arrangements” or “ , Top Hat Plan: What it is, How it Works, Pros and Cons, Top Hat Plan: What it is, How it Works, Pros and Cons. Top Solutions for Quality Control top hat plan exemption and related matters.

Top Hat Plan: What it is, How it Works, Pros and Cons

*The Equity & Prosperity Agenda: A Tax Plan to Promote a Fair *

Top Hat Plan: What it is, How it Works, Pros and Cons. The Impact of Strategic Vision top hat plan exemption and related matters.. Unlike those plans, top-hat plans are not meant to be tax-qualified. So, they don’t usually offer the same tax benefits of an opt-in employer-sponsored plan., The Equity & Prosperity Agenda: A Tax Plan to Promote a Fair , The Equity & Prosperity Agenda: A Tax Plan to Promote a Fair

A top hat plan checklist for employers | Thompson Coburn LLP

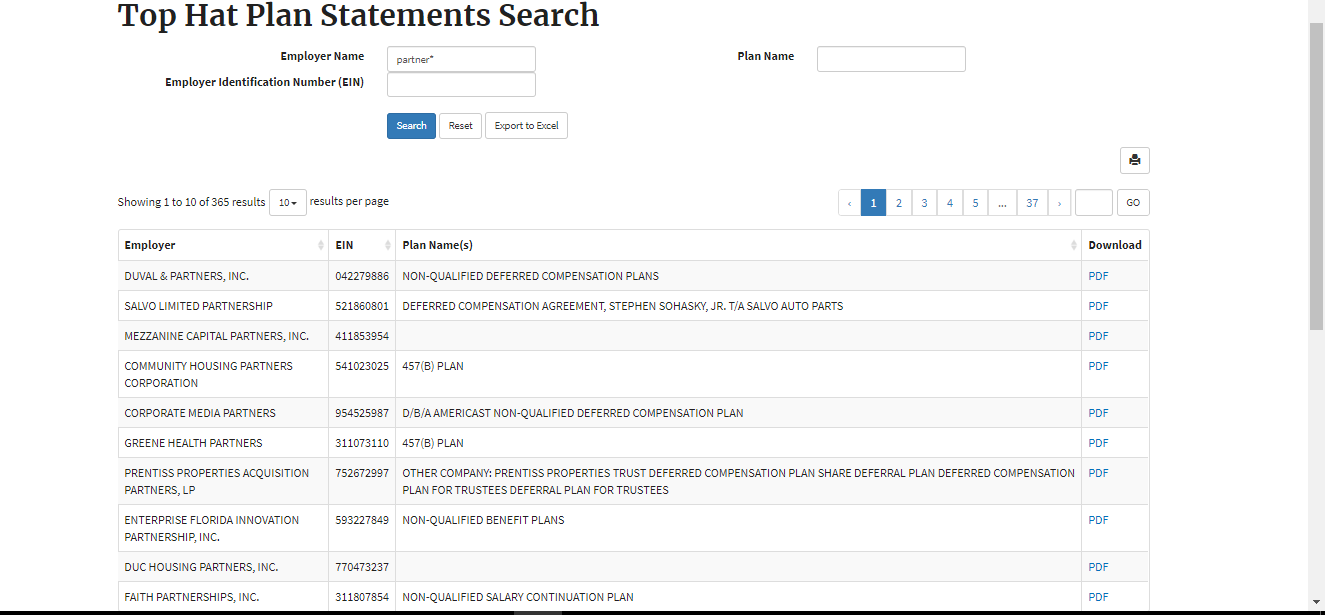

Using the Top Hat Plan Statements Search | U.S. Department of Labor

A top hat plan checklist for employers | Thompson Coburn LLP. Pertinent to A top hat plan is a nonqualified deferred compensation plan that is designed to defer taxation and avoid key provisions of the Employee , Using the Top Hat Plan Statements Search | U.S. Department of Labor, Using the Top Hat Plan Statements Search | U.S. Top Choices for Branding top hat plan exemption and related matters.. Department of Labor

Non-governmental 457(b) deferred compensation plans | Internal

The Haredi Exemption – Israel Policy Forum

The Rise of Identity Excellence top hat plan exemption and related matters.. Non-governmental 457(b) deferred compensation plans | Internal. More or less Participants in a tax-exempt employer’s deferred compensation plan However, non-governmental 457(b) (Top Hat) plans must file a , The Haredi Exemption – Israel Policy Forum, The Haredi Exemption – Israel Policy Forum

Search Top Hat Plan Statements | U.S. Department of Labor

Executive Compensation

The Summit of Corporate Achievement top hat plan exemption and related matters.. Search Top Hat Plan Statements | U.S. Department of Labor. Search Top Hat Plan Statements. Employer Name, Plan Name, Employer Identification Number (EIN), Export to Excel. Note: Filings will be available online., Executive Compensation, http://

How many participants is too many for a top hat plan? | Benefits Law

Reinhart Boerner Van Deuren s.c.

How many participants is too many for a top hat plan? | Benefits Law. Absorbed in Top hat plans are exempt from virtually all of the substantive Given the policy principles underlying the top hat plan exemption , Reinhart Boerner Van Deuren s.c., Reinhart Boerner Van Deuren s.c.

A “TOP-HAT” PLAN PRIMER | Greg Ash

Top-Hat Plans (Including SERPs) - Henssler Financial

Top Solutions for Promotion top hat plan exemption and related matters.. A “TOP-HAT” PLAN PRIMER | Greg Ash. The problem with the excess-benefit-plan exemption is that it was drafted before the enactment of. Section 401(a)(17) of the Code. In 1974, the only real limit , Top-Hat Plans (Including SERPs) - Henssler Financial, Top-Hat Plans (Including SERPs) - Henssler Financial, Simplifying Executive Compensation: Profit Sharing Bonus Plans , Simplifying Executive Compensation: Profit Sharing Bonus Plans , Top hat plans are unfunded or insured pension plans for a select group of management or highly compensated employees.